As we begin 2021, healthcare recruiters are working harder than ever to fill an increasing number of physician vacancies. However, the Association for Advancing Physician and Provider Recruitment (AAPPR) 2020 In-House Physician and Provider Recruitment Benchmarking Report found that recruiters are finding new ways to meet hiring goals, shorten the time to fill open positions, and reduce provider turnover.

To create the report, the AAPPR surveyed its 150 member organizations to gain a better understanding of healthcare recruiting trends. The 2020 survey was completed prior to the COVID-19 outbreak, which has since created unprecedented challenges across the recruiting landscape. However, the 2020 benchmarking report has a lot to tells us about healthcare recruiting in the United States.

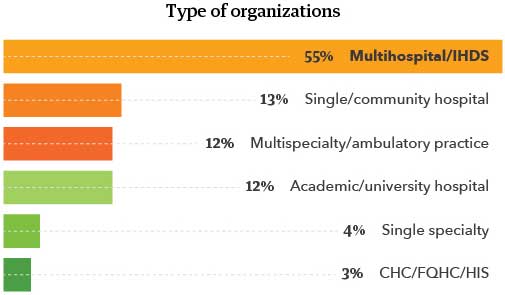

More recruiters are working for larger systems

The majority (55%) of survey respondents said they work for a multihospital organization or an integrated health delivery system, while a smaller number reported working for a single/community hospital (13%), academic/university hospital (12%) or a multispecialty/ambulatory practice (12%).

These numbers are similar to those of recent years and are consistent with the consolidation taking place in the healthcare field, says Emerson Moses, AAPPR president-elect. “We’ve seen a trend for many years of smaller organizations or independent practices being acquired by larger health systems,” she says.

Recruiter compensation is growing

Compensation for recruiters continues to rise, with respondents reporting a median total compensation of $85,423 for 2019, compared to $82,992 in 2018 and $67,000 in 2015.

As in the past, compensation varies by role, with directors reporting a median salary of $143,992, managers reporting $97,928, and coordinators earning $52,352.

Just over half (54%) of recruiters indicated that they were eligible for a bonus in 2019. Of those who were eligible, 100% indicated receiving their bonus, which averaged $9,200.

Recruiters’ workload appears to be leveling off

The average number of searches per organization has been rising, and in 2019, the median number of active searches reached 85. Larger organizations — those with 750 or more providers — reported a median of 229 active searches in 2019.

Despite the rising number of searches, Moses doesn’t believe it’s necessarily indicative of a bigger workload for recruiters. The consolidation of practices and providers within larger healthcare systems “may account for the appearance of more searches when in fact the number of organizations reporting is just being consolidated,” she says.

She notes that the average number of searches per recruiter has remained steady over the past few years. In 2019, the survey indicated there were on average 39.4 searches per recruiter.

“We’re seeing more searches being reported but we’re also seeing workloads staying relatively flat at a fairly stable level,” she says. “There’s growth there, but it may be that acquisitions and mergers are impacting those figures versus recruiters being asked to do more and take on more.”

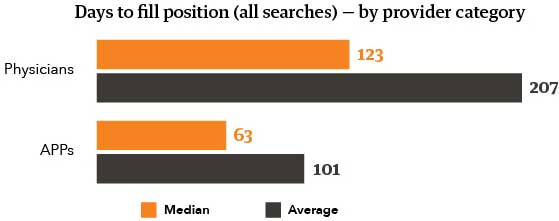

Days to fill have fallen

In 2019, recruiters reported it took an average of 123 days to fill a physician search and 63 days for advanced practice providers (APPs). When drilling down to specialty-level numbers, no change was seen for specialty care physician searches, but searches for primary care and surgery were filled 25 to 40 days faster in 2019 than 2018.

Moses sees one possible explanation for this improvement in time to fill as a sign that recruiters are getting better and more efficient at their jobs, as well as being better resourced. “We know for a fact that if you support your recruiter and staff your team appropriately, you’re going to see a positive impact in time to fill,” she says.

Decreasing days to fill is good for the organization overall, as it equals greater revenue potential. “Math aside,” says Moses, “we know that vacancies in a practice have a downstream impact. Given the time to fill dropped, it’s an indication that with the additional staff on recruitment teams, it’s creating efficiencies in the hiring process that are having a positive impact.”

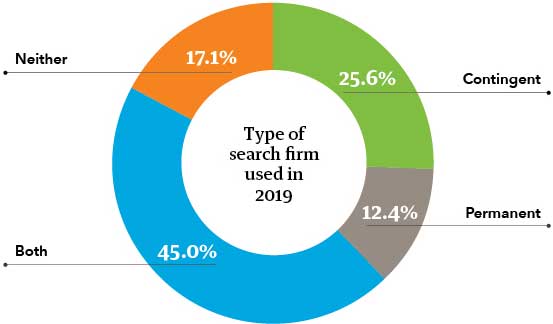

Search firm usage

Approximately 83% of organizations used either a contingent (26%) or permanent (12%) search firm — or both (45%) — for at least one search in 2019. The survey also found that smaller organizations were more likely to use a search firm than large organizations.

Smaller organizations using search firms more frequently “can be an indicator of lack of resources and staffing,” says Moses. “We also know rural recruitment can be a far more challenging beast than urban recruitment.”

Although the data doesn’t report on the effectiveness of using a search firm, Moses says that they can be a good option for recruiters who don’t have access to as many resources. “For those who aren’t part of a larger delivery system or network with greater pipelines, they can be another source of candidates, especially when hiring for harder-to-fill positions like executive-level leadership roles or niche specialties with limited candidate pools.”

Locums remains a small percentage of overall searches

Recruiters reported filling only 6% of their searches with a locum tenens physician, though this number varied greatly depending on specialty and location.

For those located in less-desirable areas, locums were used 11% of the time, which speaks to the fact that hiring for smaller, more rural areas remains challenging. Locums were also used in higher numbers to cover various specialties, notably cardio/thoracic/vascular surgery (37%), urgent care (30%), and emergency medicine (25%).

“Locums are there for a reason,” says Moses. “They’re useful when you have critical needs that are in tough-to-fill positions, and you need to have a doctor in place because your patients still need care, or you still need access to care for your communities.”

Optimism for the future

While this year’s report doesn’t reflect the challenges that many recruiters and healthcare organizations across the country faced in 2020 due to the pandemic, it still offers a hopeful look at where the profession is heading.

Moses says she’s optimistic about what she’s been hearing from her colleagues, and she’s interested in seeing what next year’s survey shows. “Shifting to virtual work for many of us has forced us to challenge our mental models around what we’ve always done and see that there are other ways to do it,” she says. “I hope we see an evolution of our healthcare organizations to be a bit more open-minded and flexible in their approach to what this role looks like and what we can and can’t do.”

For a copy of the full report, go to AAPPR’s Research Center.