2025 State of Locum Tenens Report

A comprehensive look at the locum

tenens industry

The State of Locum Tenens in 2025

CEO & President of CHG Healthcare,

Leslie Snavely

We’re excited to share CHG Healthcare’s 2025 State of Locum Tenens Report—a deep dive into how locum tenens is playing an increasingly strategic role in today’s evolving healthcare landscape.

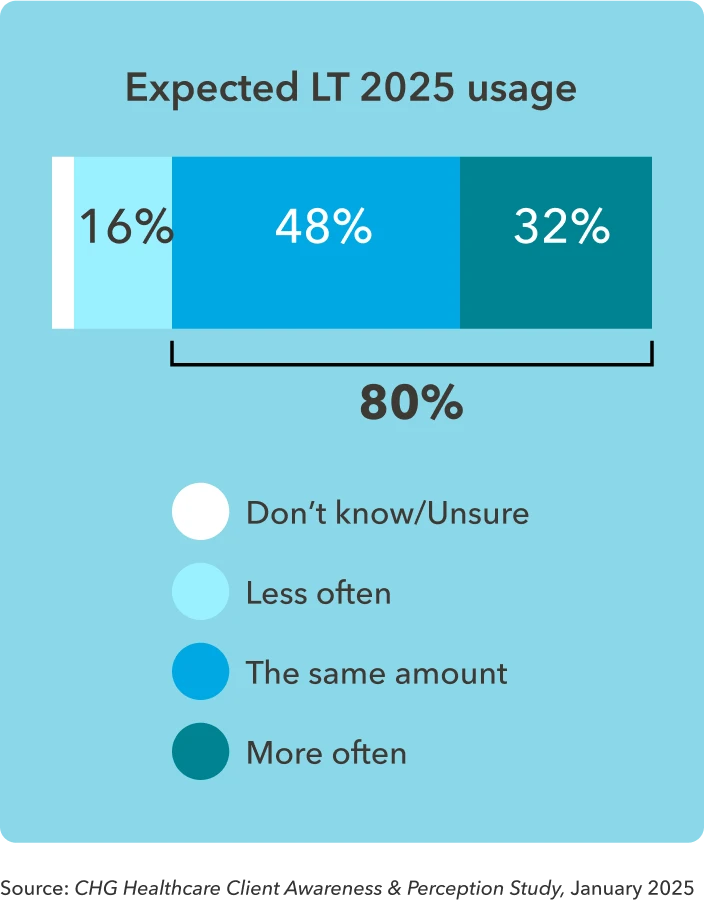

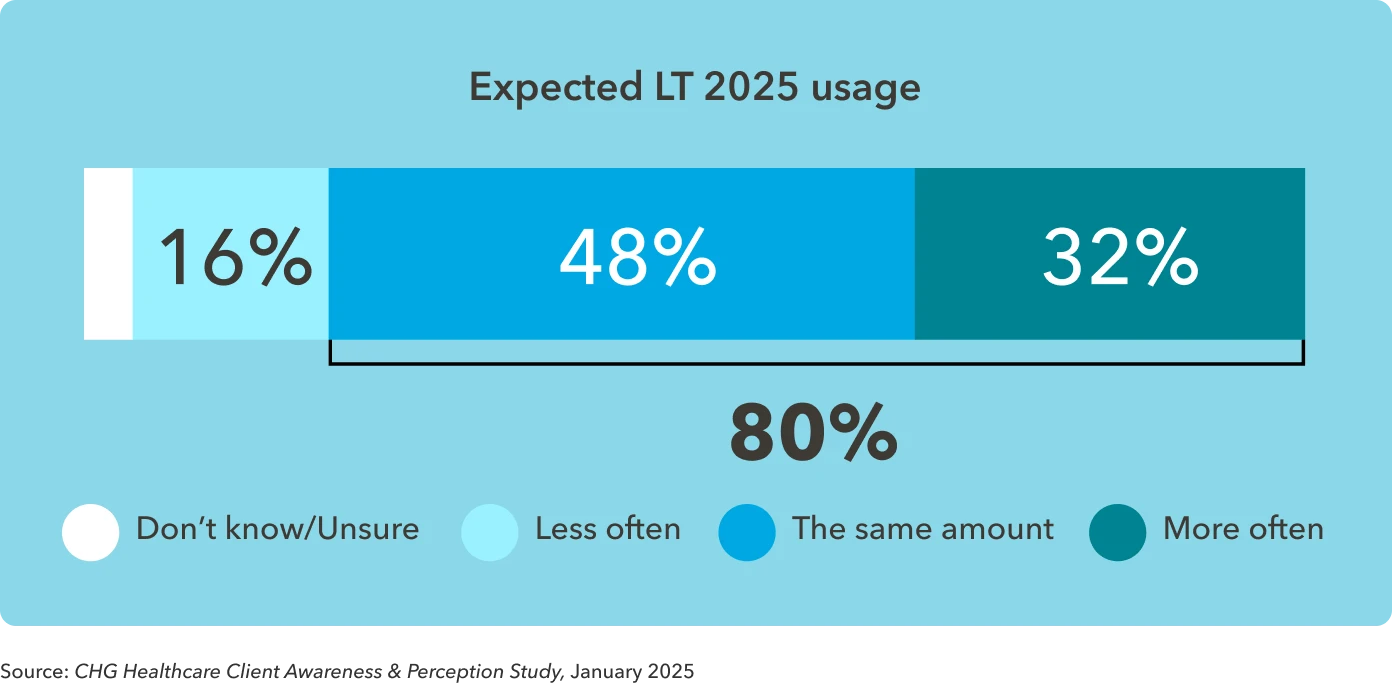

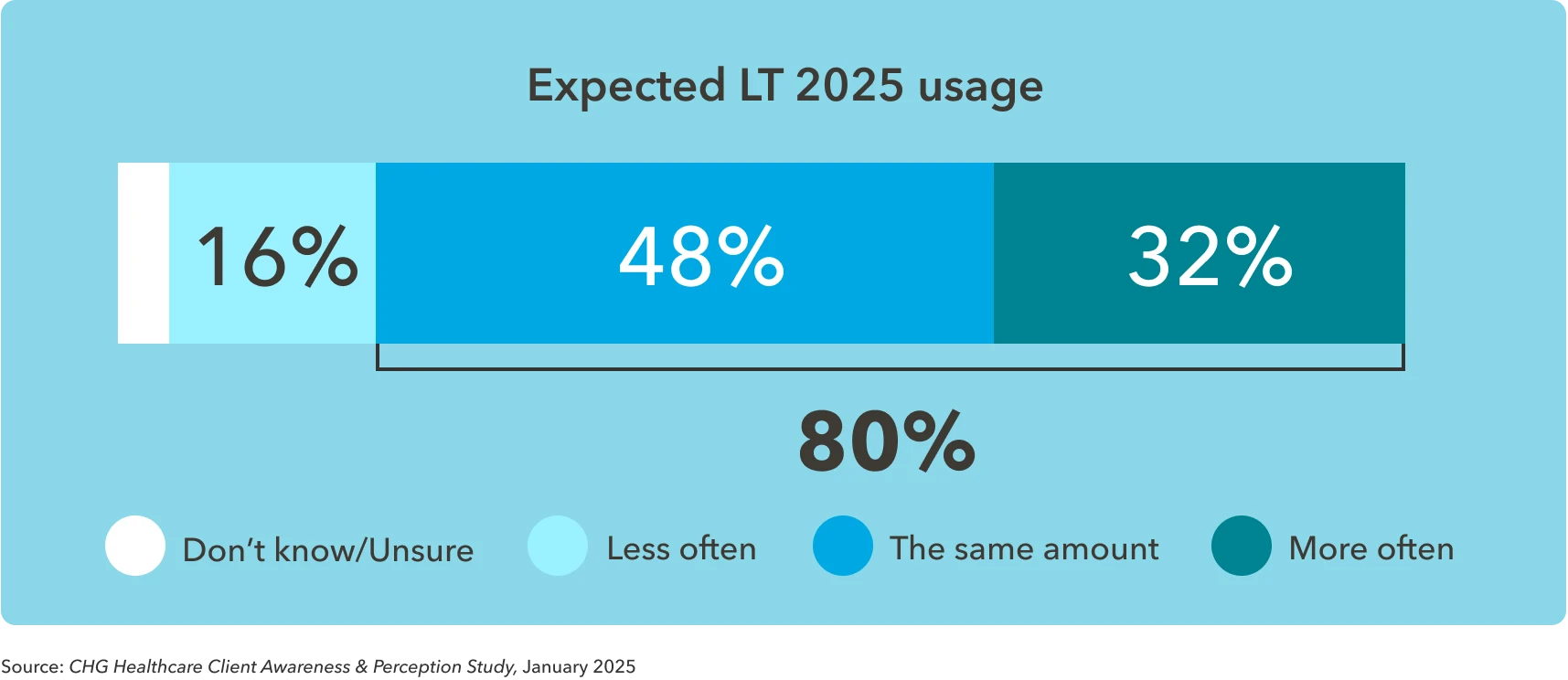

What we’re seeing is clear: Locums isn’t just a temporary fix anymore. It’s become a core part of how hospitals and health systems are tackling staffing challenges, maintaining continuity of care, and preventing provider burnout. In fact, locum tenens is the only area of temporary healthcare staffing that’s grown every year since 2021—and is expected to keep growing through 2026. Eighty percent of organizations plan to maintain or even increase their use of locums through 2025.

This year’s report also highlights how healthcare leaders are using locums in new ways, from supporting organizational transitions and testing out new service lines to helping providers find a better work-life balance. On the flip side, locums is proving valuable for physicians too, offering flexibility, career development, and supplemental income.

We also dive into the growing role of technology, like vendor management systems, which are making it easier to manage locums more efficiently and cost effectively.

There’s no doubt that locum tenens is evolving, and this year’s report gives a clear picture of where it’s headed in the future.

Thanks for taking the time to explore this year’s insights. We hope it sparks ideas and conversations that help move your organization forward. We’re here to partner and provide insight to help you adapt in the ever-changing healthcare landscape.

Warm regards,

Leslie Snavely

CEO, CHG Healthcare

Read less

Read more

Introduction

Since its inception in 1979, locum tenens has become a mainstay of healthcare staffing. The locums industry sprang from a need to enable overstretched rural healthcare physicians to take time away from their practices. But this early concept tapped into a deep demand throughout the healthcare industry and has officially evolved as a strategic lever that communities nationwide depend on to preserve patient care access.

Locum tenens has grown into a $9.4 billion industry that serves as many as one in three U.S. patients each year.1, 2 CHG Healthcare both founded the locum tenens industry and has evolved it to meet today’s modern demands with offerings that allow healthcare organizations to meet their clinical workforce needs—including locum tenens, permanent placement, technology solutions, and strategic advisory support.

In addition to filling gaps, locum tenens has become an integral part of most healthcare organizations’ strategies for preventing burnout and retaining physicians during a time of ongoing physician shortages. With an average physician turnover rate of 10.2%, replacing lost physicians is costly, time consuming, and difficult, with only 2% of physicians reporting that they’re actively looking for a new position.3

Locum tenens is not a comprehensive solution to the staffing challenges facing healthcare today—but treating it solely as a temporary fix or a last resort is no longer sustainable.

We as a group have to figure out how to see more patients without doctors. We can't keep throwing people to the problem we have.”

- Chief physician executive, leading health system; Academy IQ spring forum debrief

The physician shortage is not a future concern. It’s a present reality affecting access to care across the country. As we look at the locum tenens industry in 2025, it’s clear that it must be viewed as a strategic resource—one that supports continuity of care, enables flexibility, and helps health systems respond to evolving workforce demands.

As Bobby Mukkamala, MD, president of the American Medical Association, recently emphasized, "There are tremendous gaps in healthcare today that require the attention of physicians and leaders in organized medicine—but it all starts with timely access to quality care." Locum tenens may not solve every challenge, but its thoughtful integration into workforce planning is essential for sustainable care delivery.

Locum tenens' role in the physician workforce

Now in its fifth decade, locum tenens has become a strong complement to permanent staffing by addressing physician needs while enabling healthcare organizations (HCOs) to meet patient care and financial stability goals.

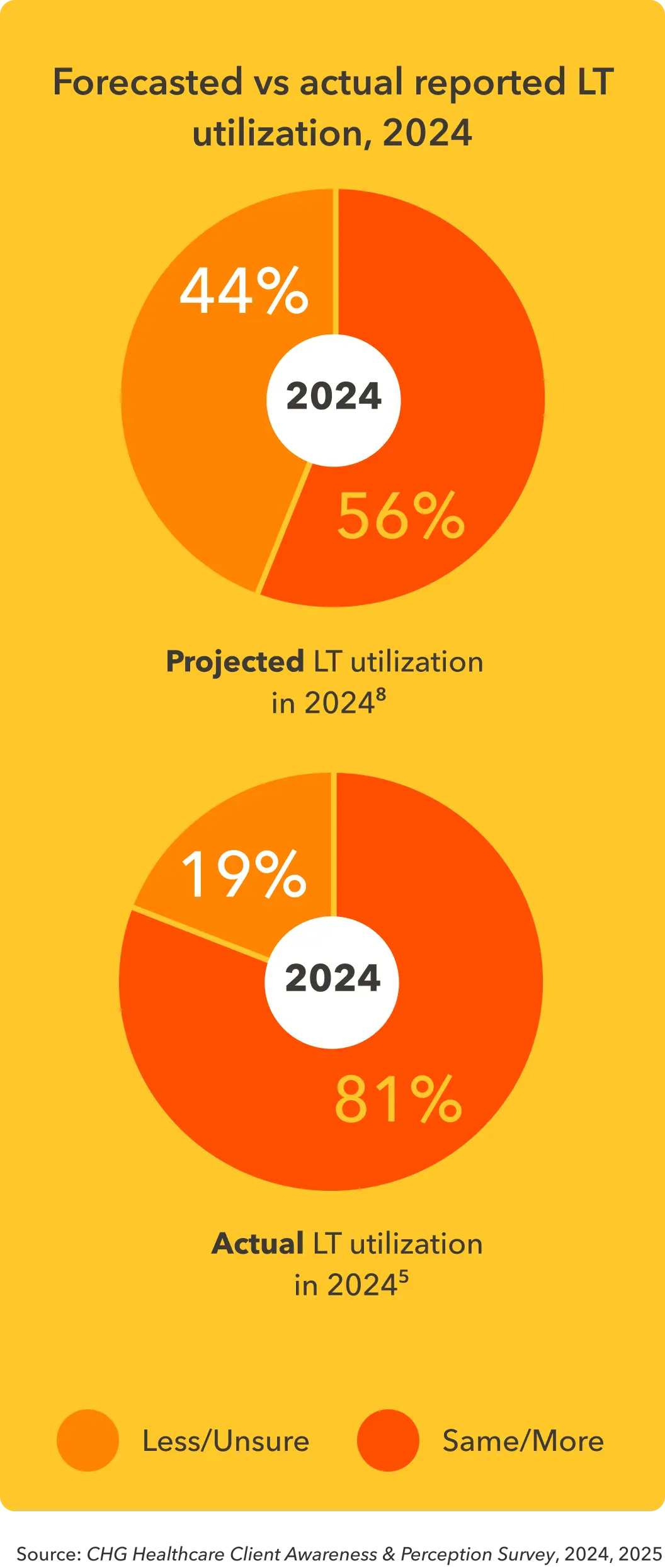

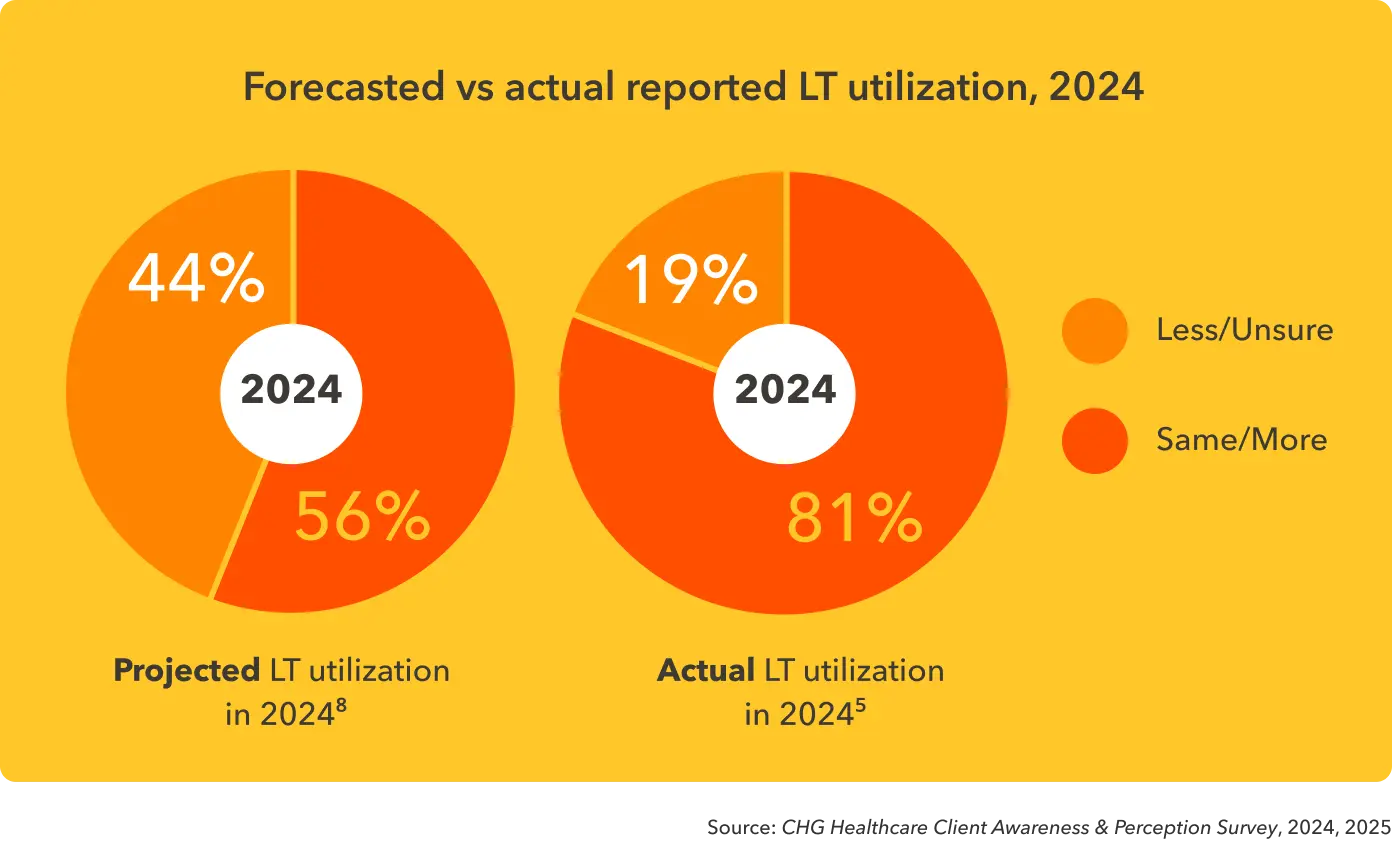

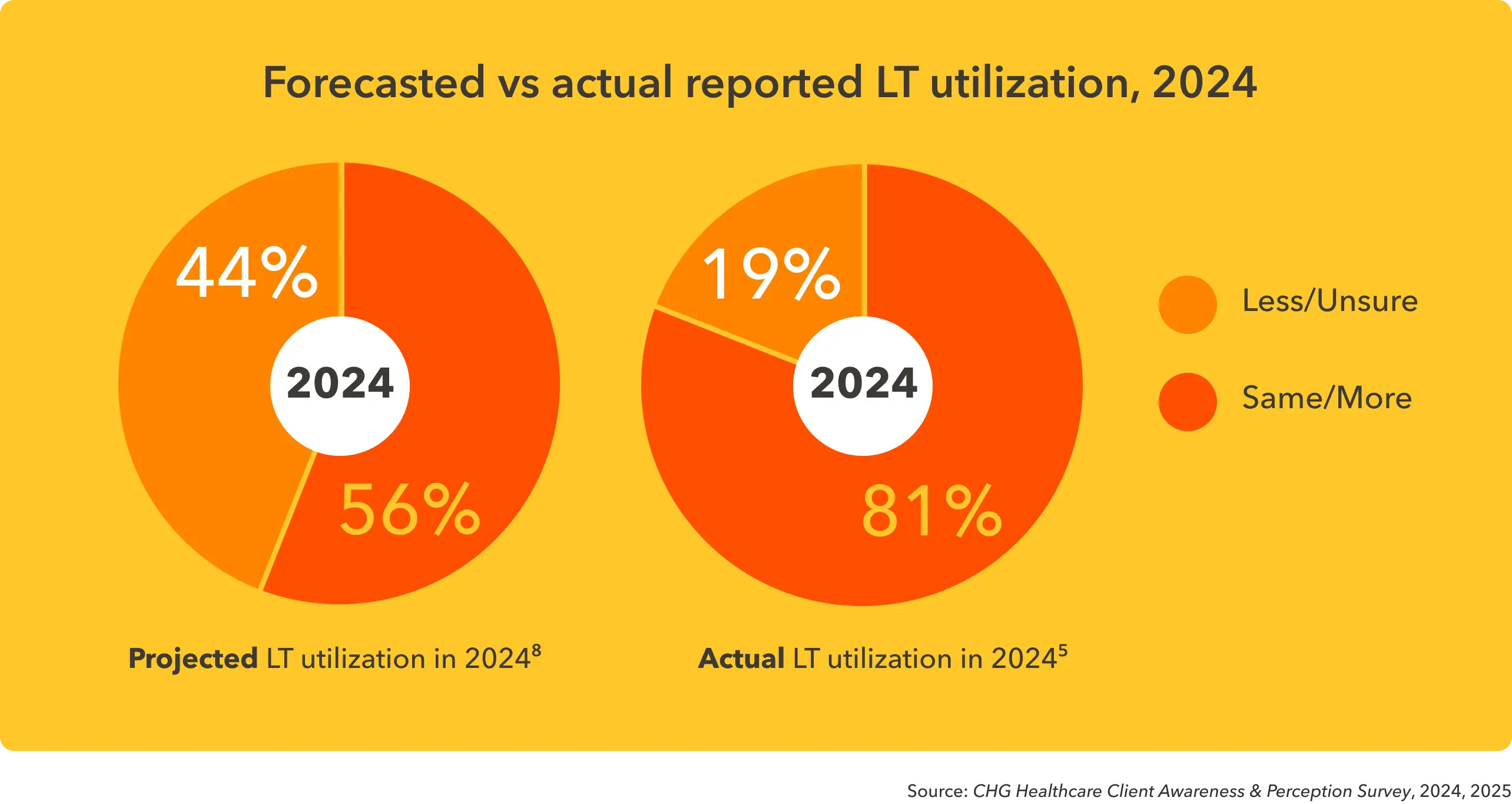

Despite the growing adoption of locum tenens, HCOs have often failed to proactively plan for their utilization. By the end of 2024, HCOs reported that their actual locums utilization was 25 percentage points higher than they anticipated going into the year.

The good news is that healthcare staffing planners are finally starting to incorporate locums more purposefully into their overall physician workforce strategies. Four in five (80%) of facilities expect flat or growing usage of locums in 2025.

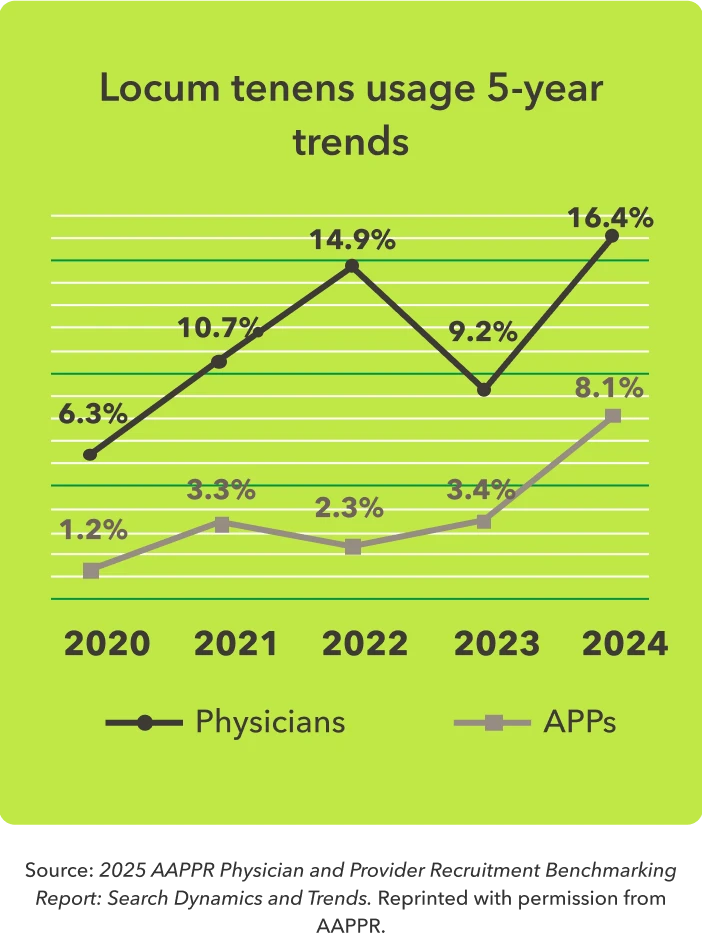

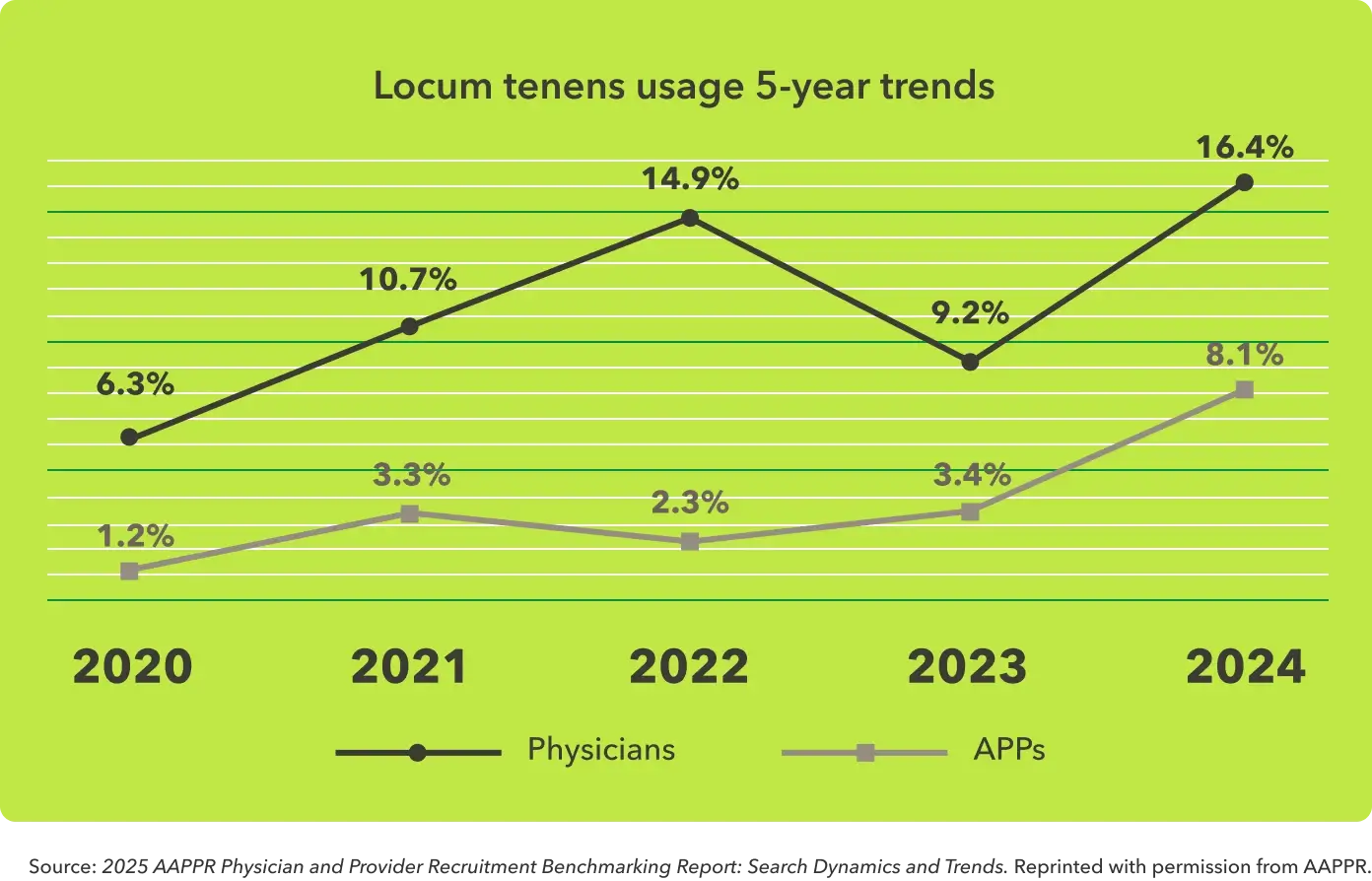

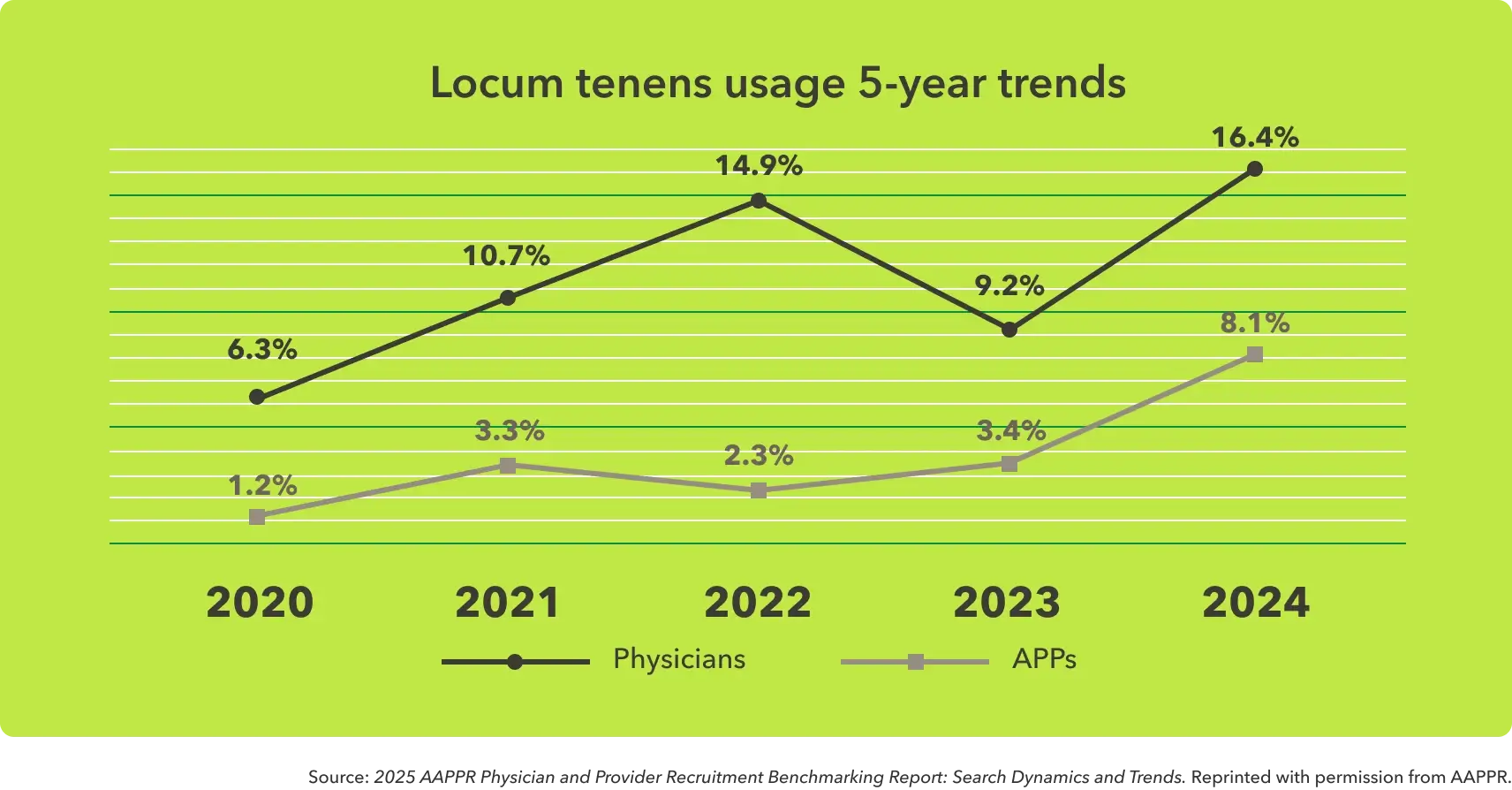

Recruitment trends show continued reliance on locum doctors. Although usage briefly dipped in 2023, five-year data reveals a strong upward trajectory. In 2024, locum tenens were used in 16.4% of physician searches and 8.1% of APP searches—the highest rates recorded to date. This reflects a growing strategy to maintain coverage while permanent hires are being sought.

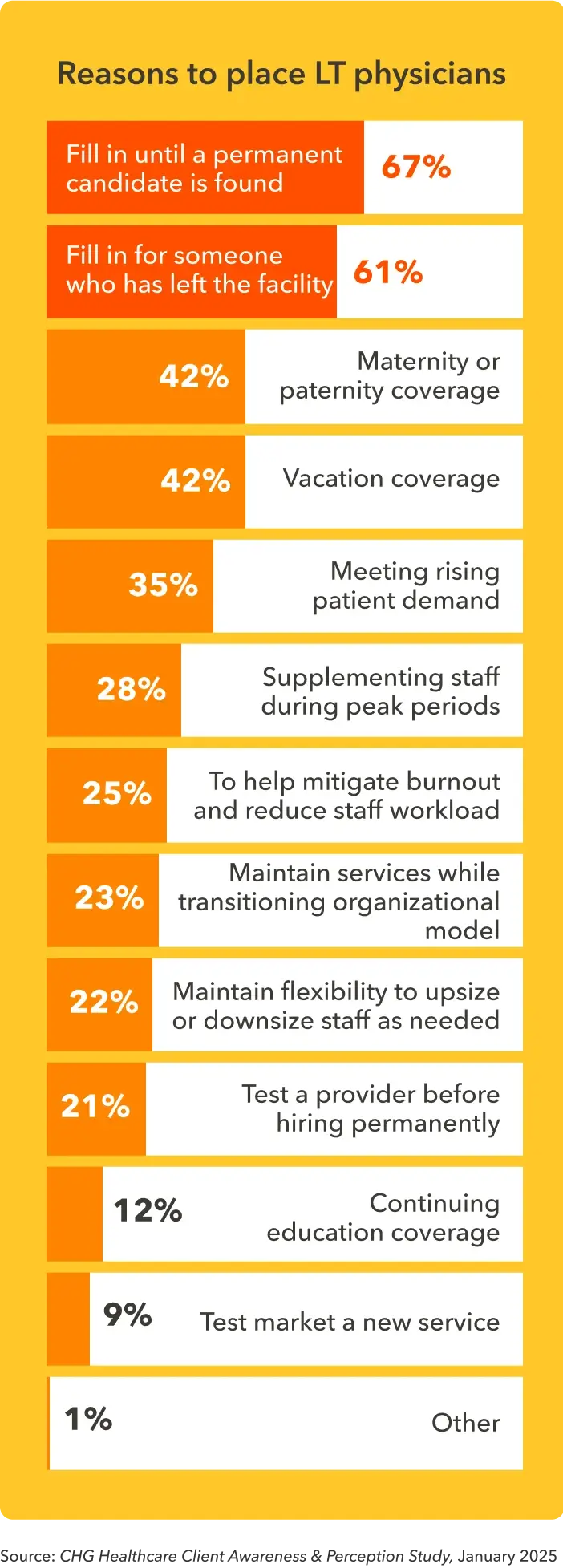

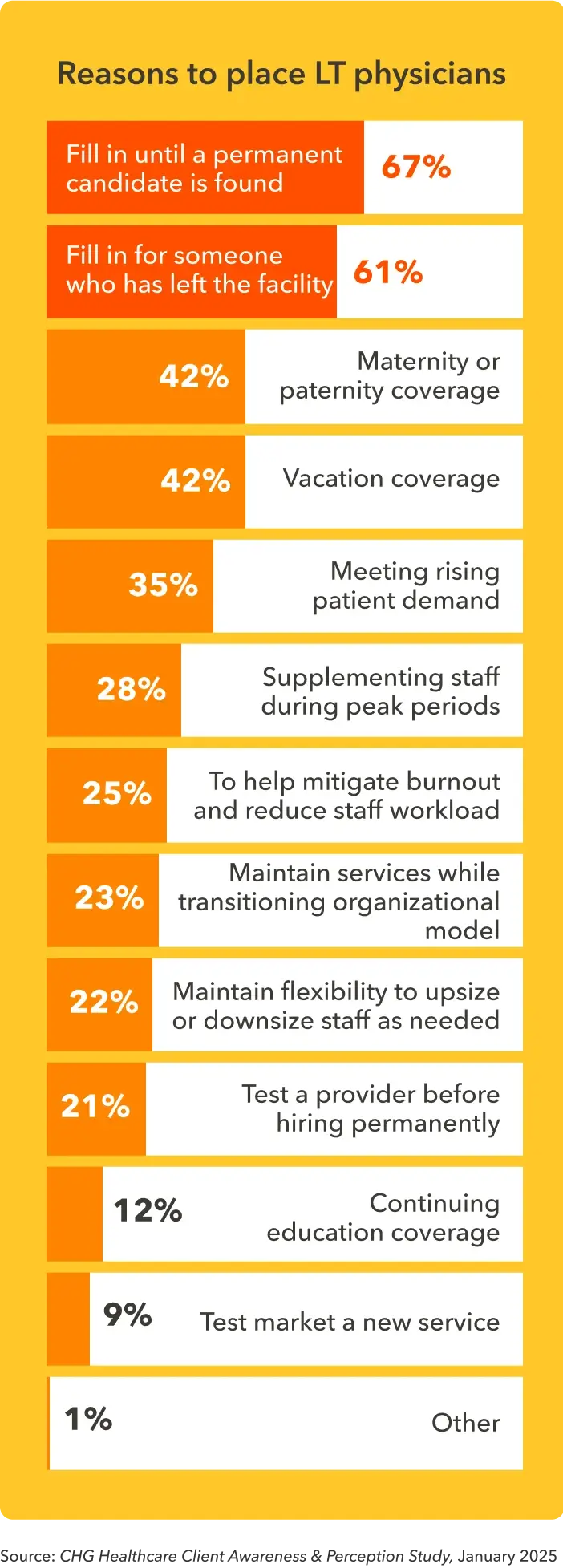

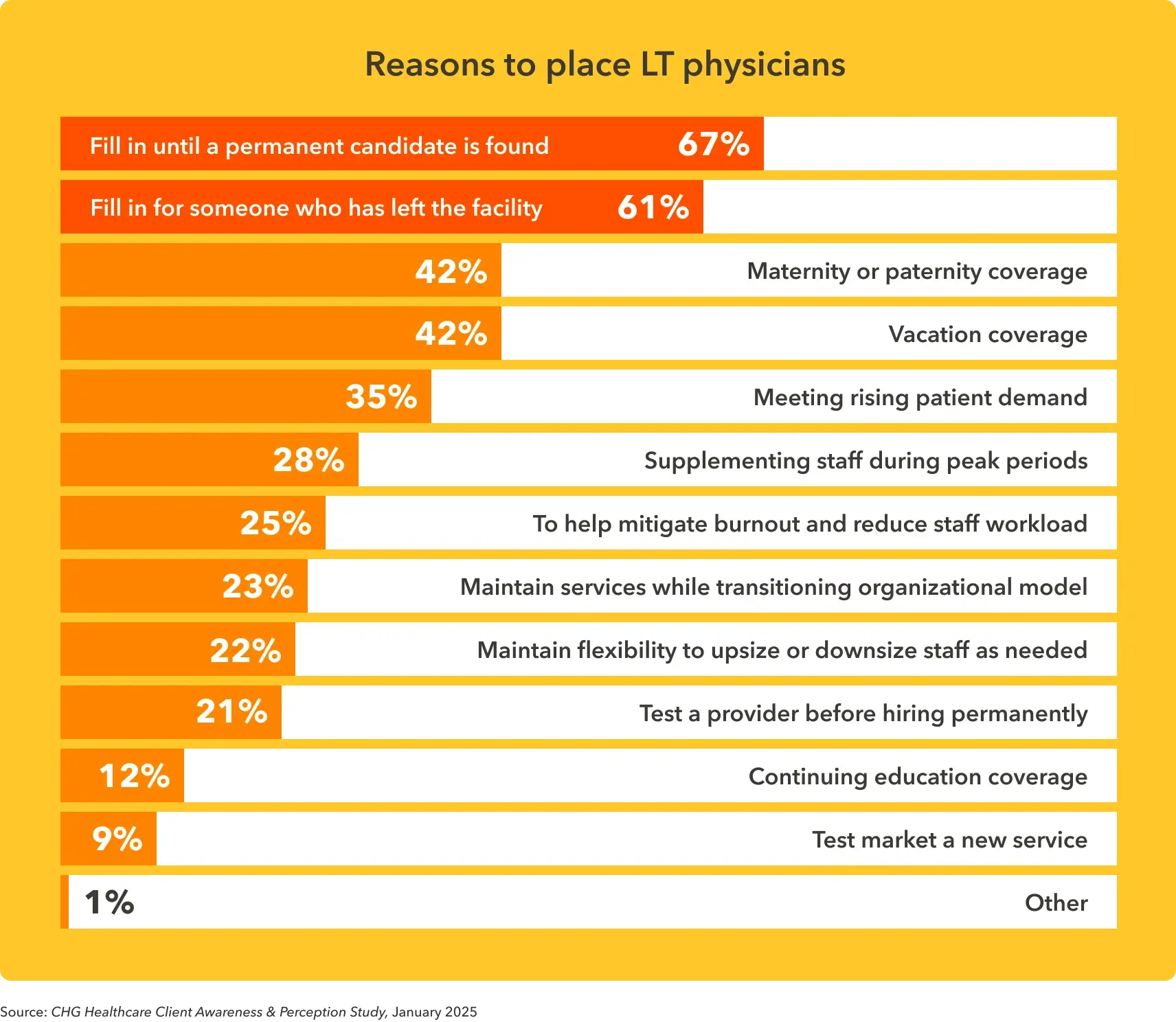

Covering a care gap is the most common reason for healthcare organizations to use locum tenens physicians. For example, 67% of healthcare organizations use locums to fill in until a permanent candidate is found, while 61% use them to fill in for someone who has left the facility.

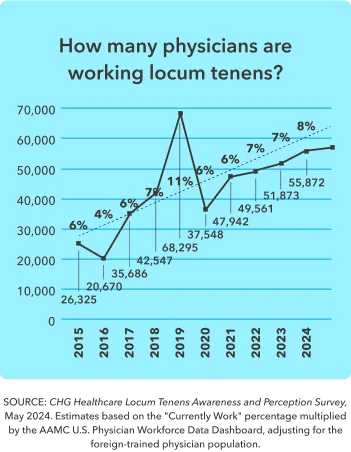

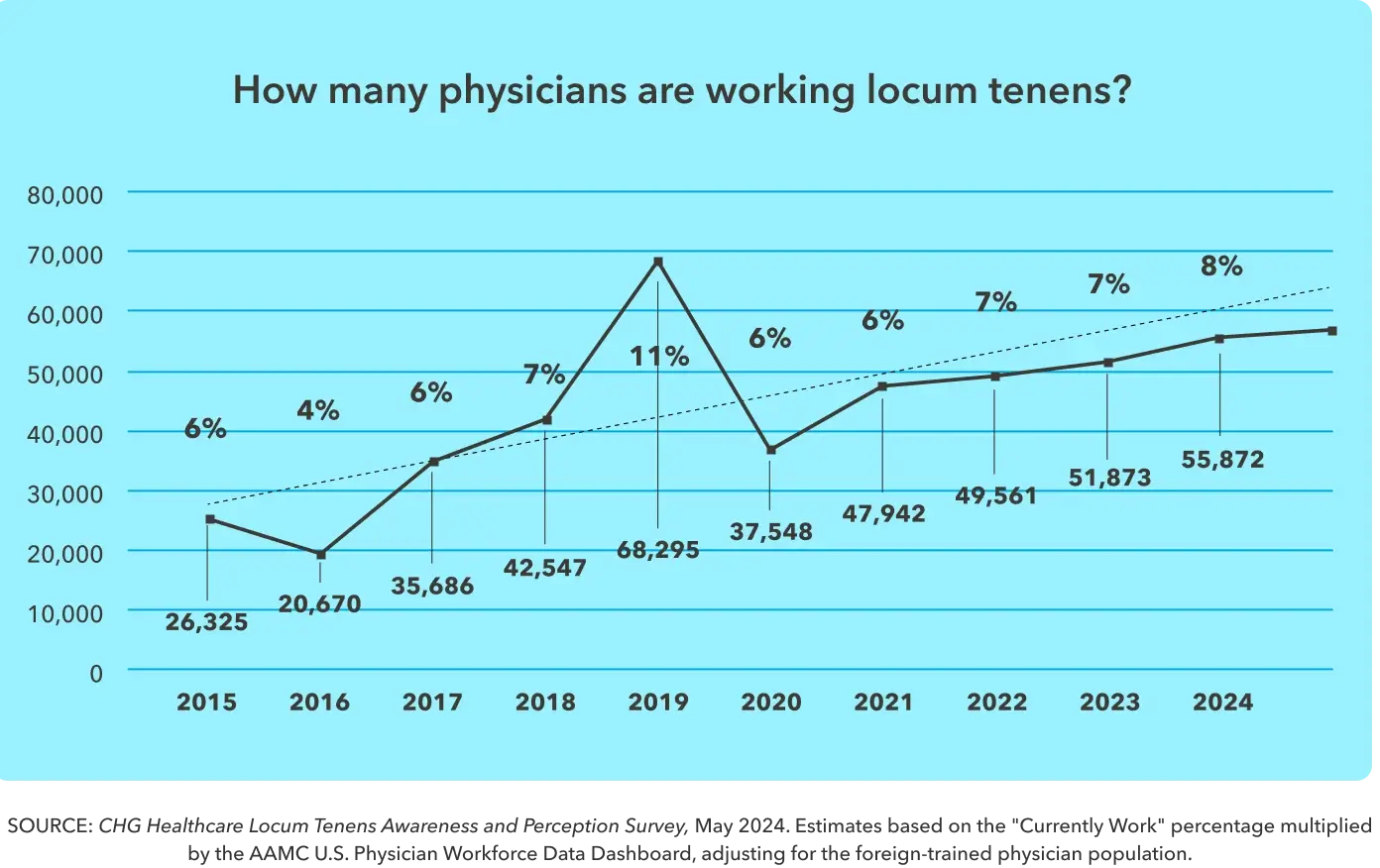

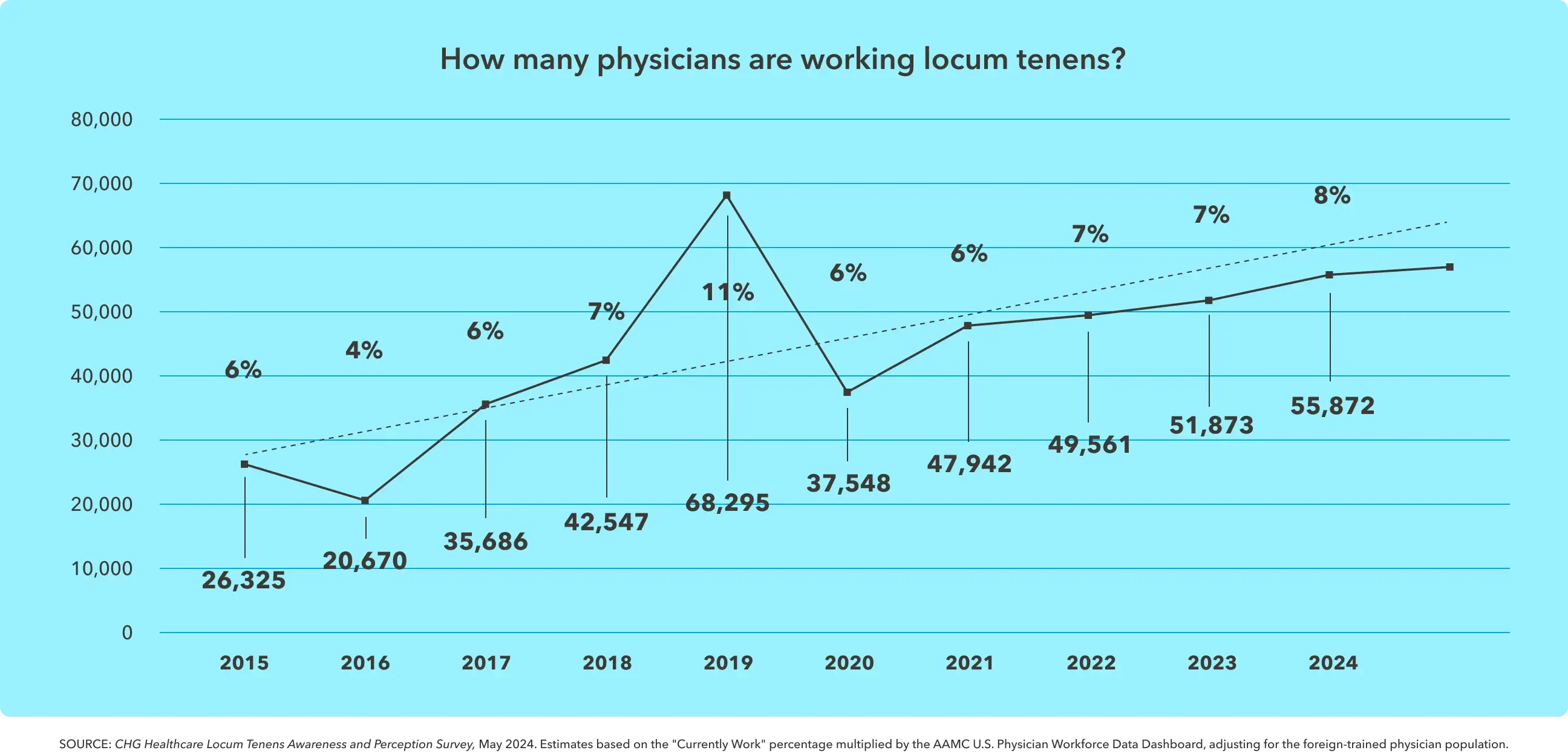

On the physician side, interest in locum tenens remains robust. The number of physicians that are working locum tenens has grown steadily since 2020, with about one-third of eligible U.S.-based physicians having had experience working locum tenens. As of May 2024, 8% (or 57,000) of physicians report that they are currently working locum tenens, with another 27% reporting that they have worked locum tenens in the past.

experience working locum tenens.4

Profile of the modern locums physician

Diverse, local, and capable

Just as healthcare organizations are becoming more strategic with their use of locums, physicians are turning to locums work to help them achieve specific career or financial goals. Locum physicians today tend to be younger and reflect the diversity of the general physician population.

Appeal of locum tenens

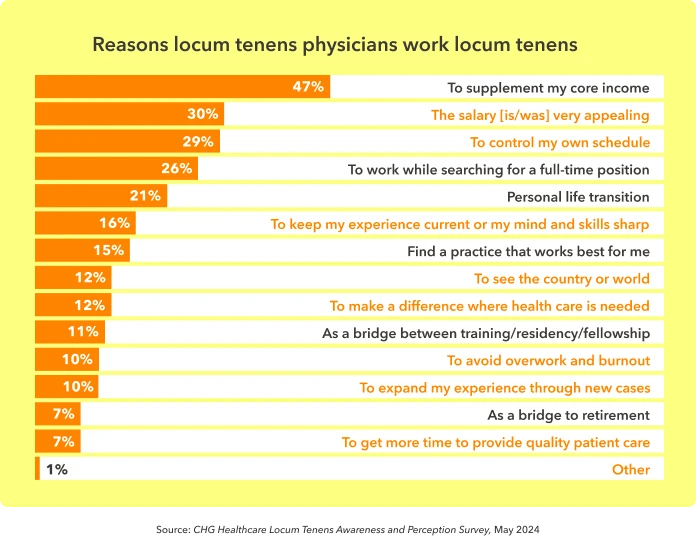

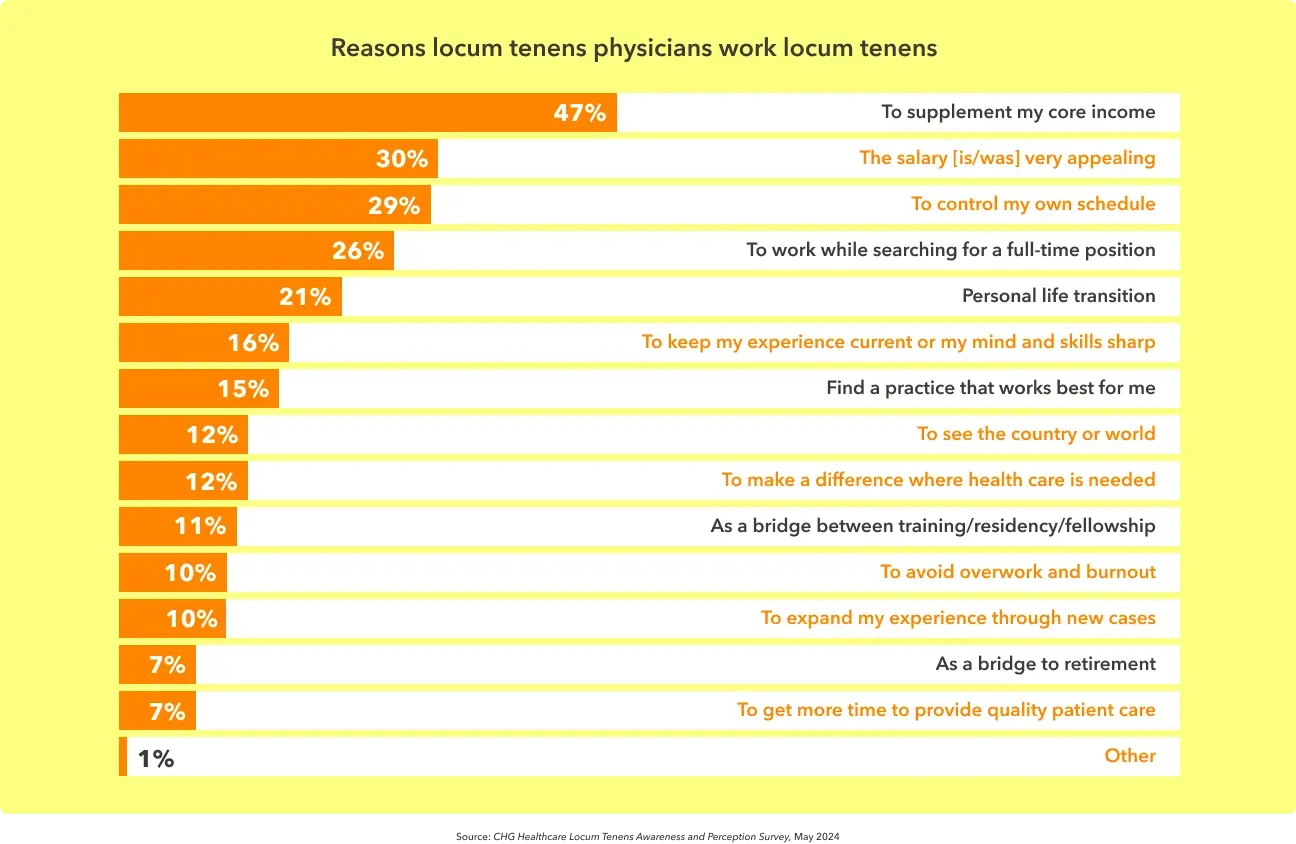

The reasons locums physicians offer for working locums demonstrate a desire for more control over their careers and lives. Unsurprisingly, financial motivations top the list, but lifestyle motivations also make a strong appearance. Some physicians turn to locums work as a key stepping stone in their careers. For example, 26% work locums while looking for a full-time position; 15% turn to locums to find a position that works for them; 11% use it as a bridge between training, residency, or a fellowship; and 7% rely on locums as a bridge to retirement.

After stopping locum tenens work, 85% of physicians return to full-time, permanent employment, which further demonstrates that locums can help facilitate career transitions.3

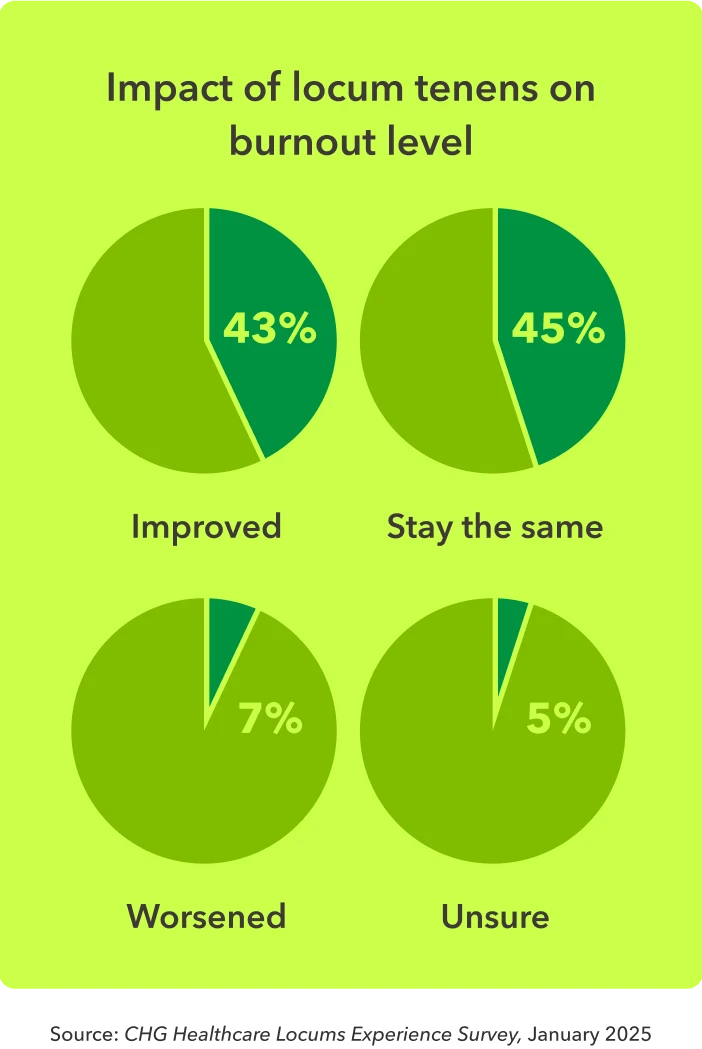

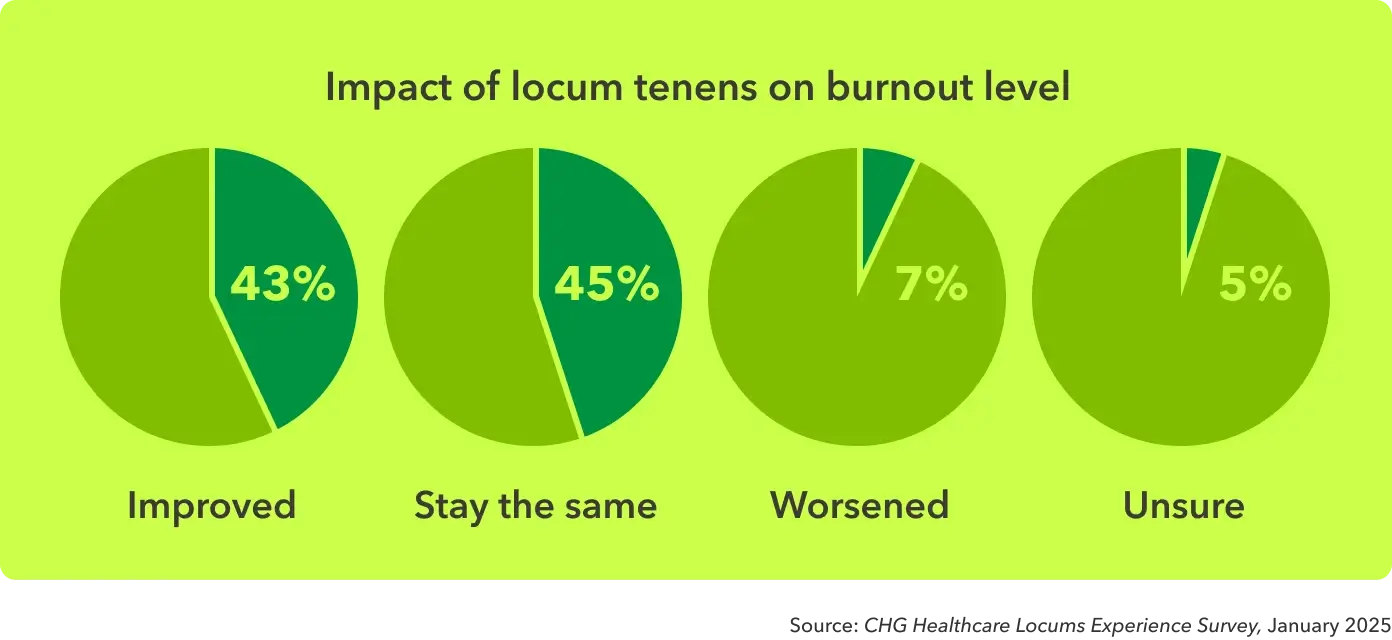

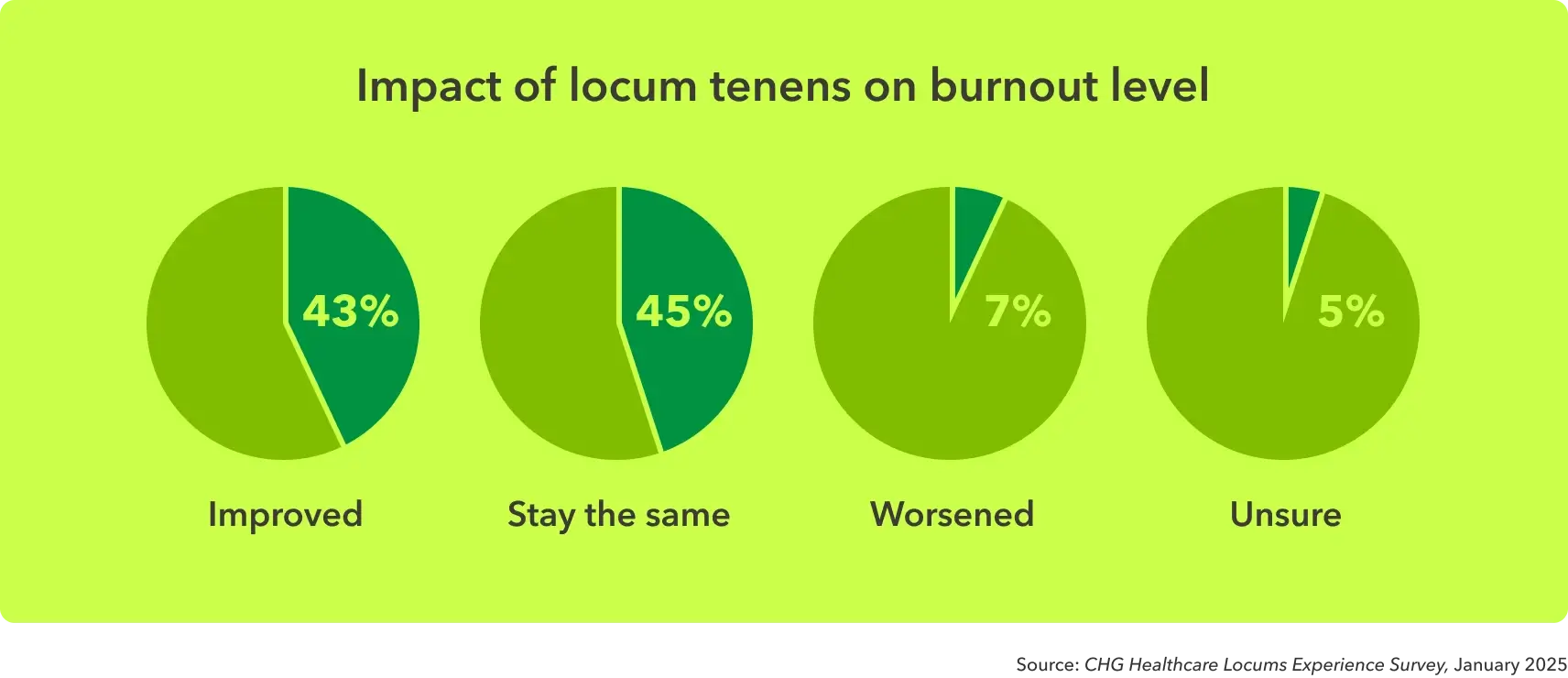

Beyond the locum tenens compensation and schedule flexibility, physicians are ultimately turning to locums as a lifestyle choice. Nearly 1 in 3 (29%) of physicians work locums to gain more control of their schedule, and 10% explicitly chose locums to avoid overwork and burnout. This approach appears to be effective for at least 43% of physicians who report their symptoms of burnout improved after working locum tenens.

I found that I get more satisfaction out of medicine by doing locums than when I was working in a full-time practice. I was just completely burned out, and locums made me enjoy being a doctor again.”

- Dr. Jaqueline Brown, MD, OB-GYN

Demographics of locum tenens physicians

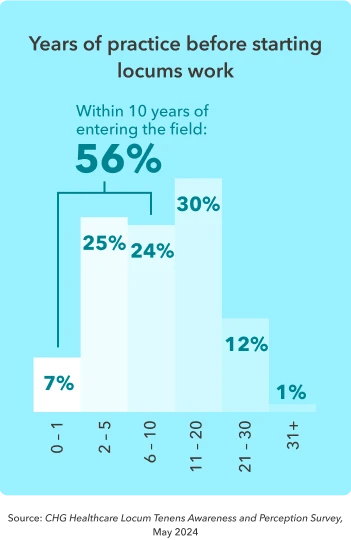

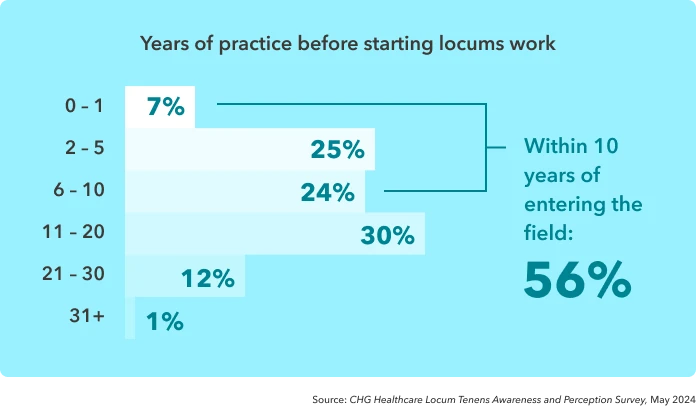

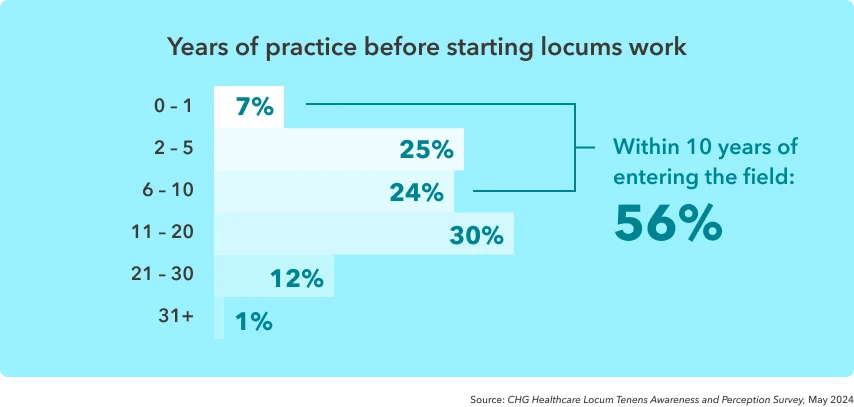

Physicians who work locums do so throughout all stages of their careers, often starting early on. The majority (56%) of locum physicians begin locums work within 10 years of entering the field.

Locums helped me make ends meet as a resident and pay off some bills. It became extremely valuable because I was able to see the diversity of different practices and find out what I liked and didn’t like. When it came time for me to make a job transition, I was armed with a lot more information.”

- Dr. Larry Daugherty, MD, radiation oncology

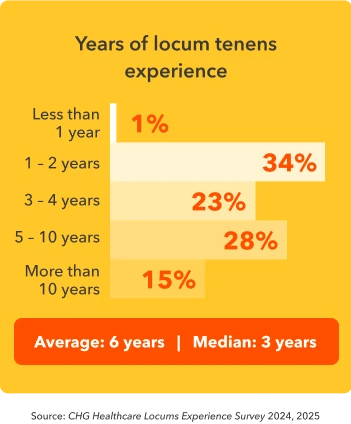

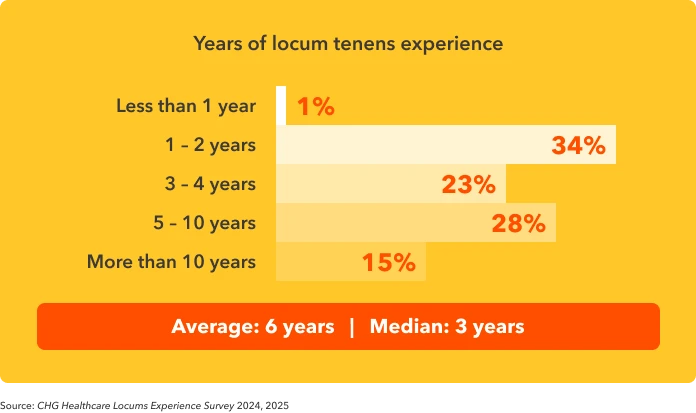

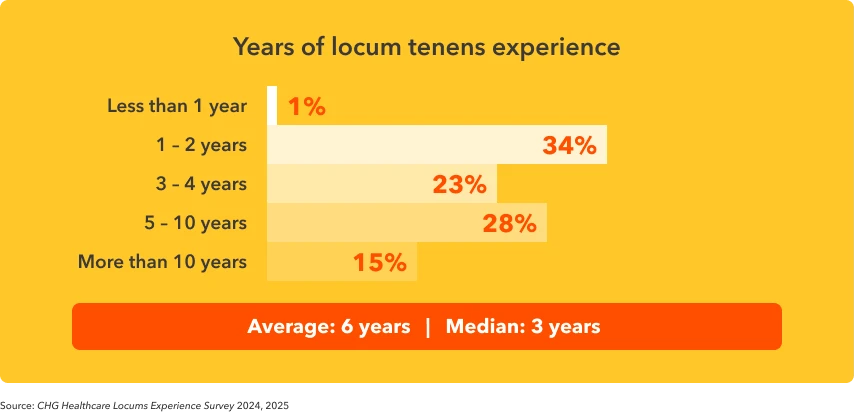

Physicians who decide to work locums tend to continue with it. The average provider has six years of locums experience, while 15% have 10 years or more.

The longevity of these locums careers suggests that the work offers more stability than previously assumed. However, it is still less common for a physician to work locums exclusively. Two-thirds (63%) have worked locum tenens in addition to an employed position or private practice role.4

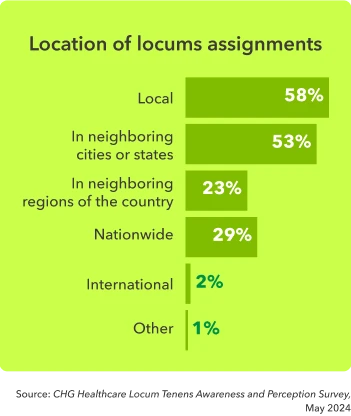

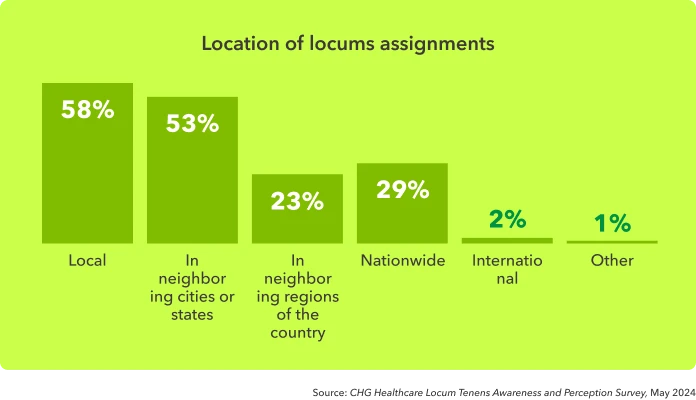

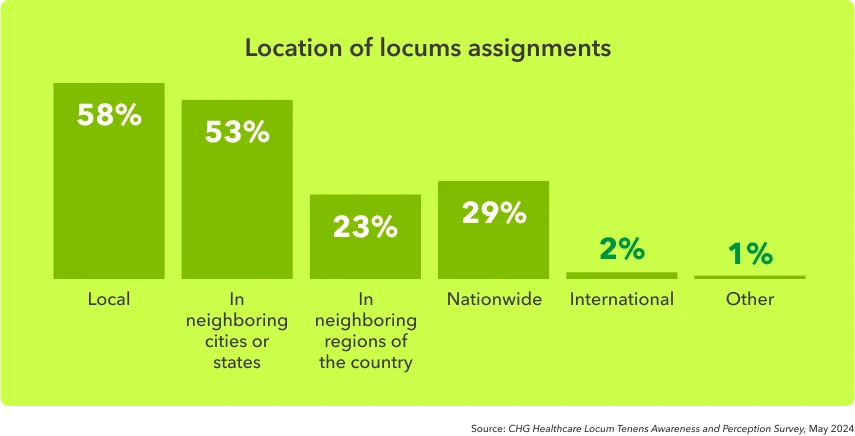

Another common misperception of locums is the requirement of extended travel, but survey data suggests that locum providers also serve in their own communities, choosing assignments that are local (58%) or in neighboring cities or states (53%).

One of my placements is literally about two miles away. The other one is about five miles away, and the third one is probably 10 to 15 miles away. Those have been pretty easy and really convenient.”

- Dr. Michael Cormican, MD, trauma surgery

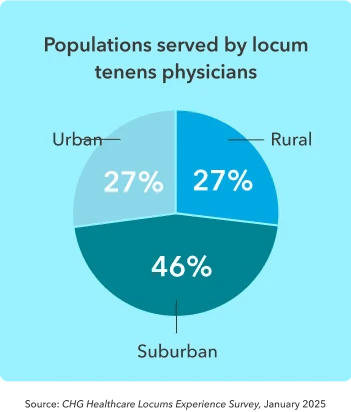

Searches that include locums cover the spectrum of geographies and specialties. Locum physicians report working in urban and rural communities about equally, while assignments in suburban locations remained the most common.

This marks an increase from 2024, when rural assignments accounted for 34% and suburban for 40% of populations served by locum providers. This shift may be partly due to an aging population relocating from urban centers to suburban communities.

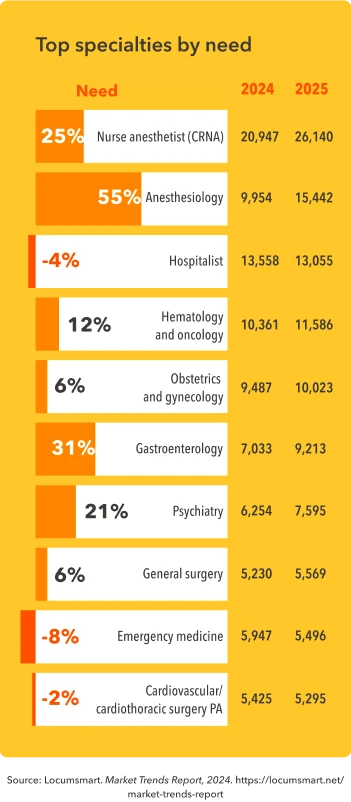

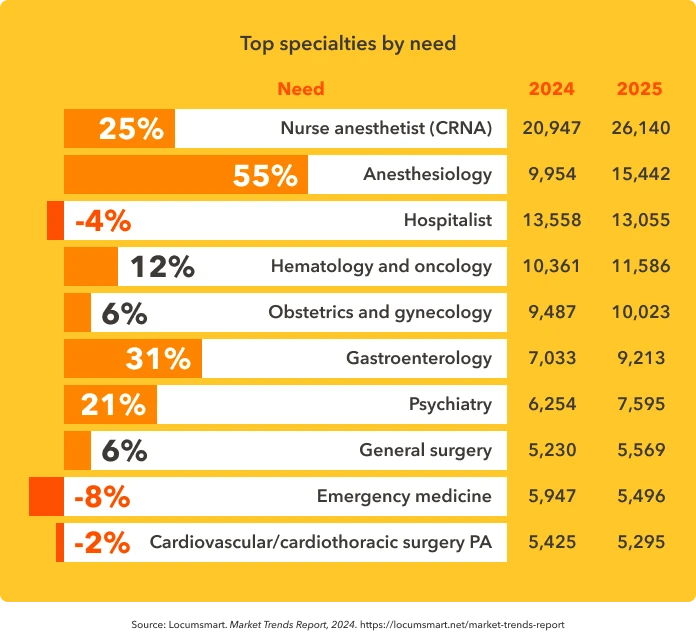

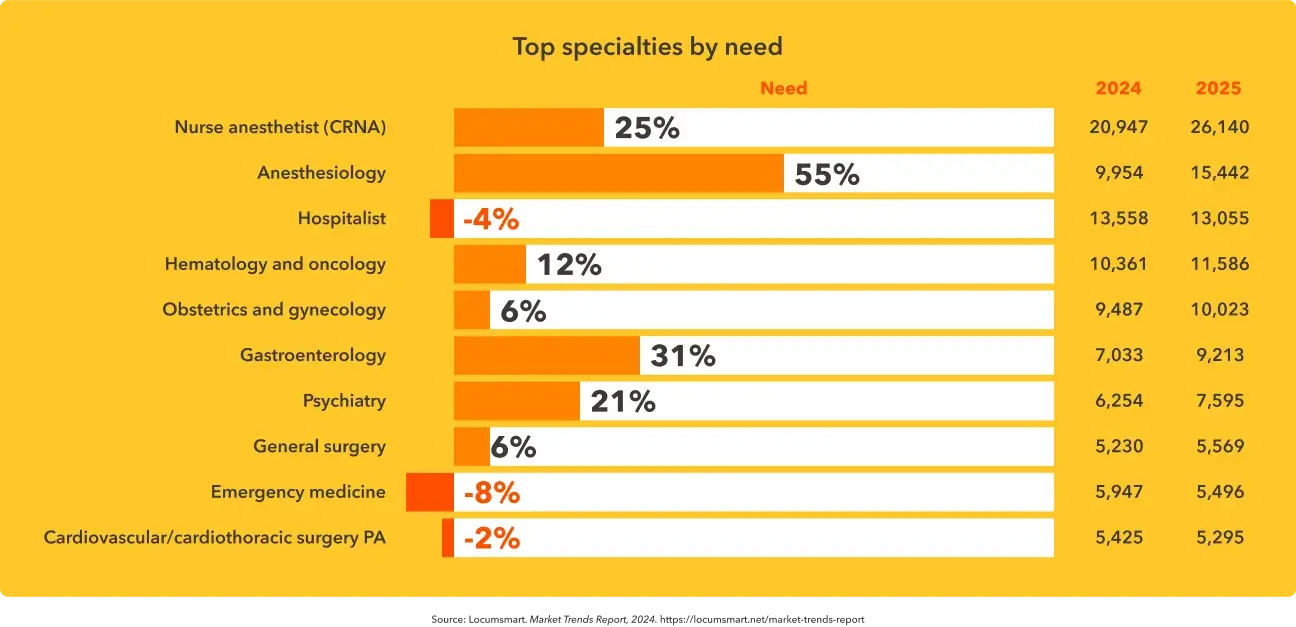

Demand for various specialties ebbs and flows, but examining projections from Locumsmart, the largest vendor management system purpose-built for locum tenens physician staffing, gives us a sense for future demand trends. Anesthesia services top the list, with a 55% expected demand increase. Hospitalist demand, while expected to decline, would remain the third most requested specialty.

Clinical quality of care

Patient outcomes and readmission comparable to staff physicians

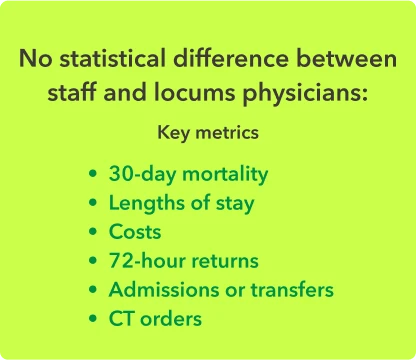

As well as being experienced and adaptable, studies show that the care given by locum providers is equal in quality to the care given by staff providers:

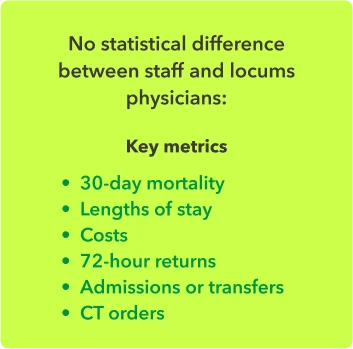

- A retrospective analysis of 1.8 million hospitalized Medicare patients found no significant difference between patients treated by locum providers and those treated by permanent staff in terms of 30-day mortality.

- A study of locums neurosurgeons found no difference in short-term complication rates, lengths of hospitalization, or costs between locum and non-locum providers.

- An analysis of emergency department providers found no statistical difference in several metrics, including 72-hour returns, admissions or transfers, and ED length of stay, among others.

- One study found cost savings linked to locum providers—admitted hospital patients saw an average length of stay that was one day shorter when they were seen by a locum provider, which led to an adjusted average hospital cost saving of $1,339.

Perception of locums by administration

Healthcare facility staff value locums’ contributions

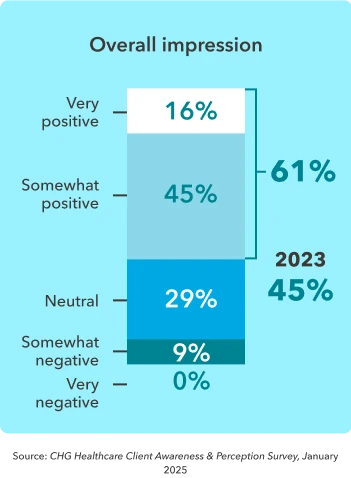

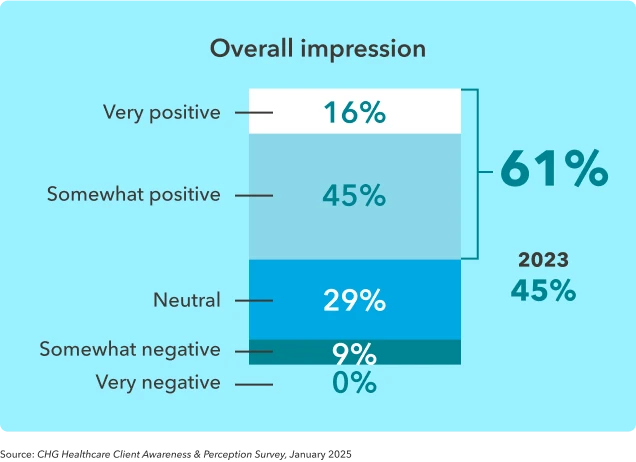

With comparable background, work experience, and clinical outcomes to staff physicians, today’s locum medical doctors are being viewed more favorably than ever before. Nearly two-thirds (61%) of hospital decision-makers surveyed said they had a positive impression of locum providers who worked in their facilities, up from 45% in 2023. Another 29% report their impression is "neutral."

People need to understand the importance of locums providers. They fulfill such a critical need. They come into an organization that they don't know, to work with people that they don't know, and not on a consistent basis. That's really hard to do, so they are really good physicians and very important. People just kind of think, “Oh gosh we have to bring a locum in…” but the locum is really doing us a great service. We really appreciate it.”

- Marsilena (Marcy) Lechner, director of provider recruitment and support services, Stormont Vail Health

New and evolving locum tenens use cases

The healthcare industry is constantly adapting to new technologies, regulatory uncertainties, payer pressures, and market demands. Locum tenens allows healthcare organizations to remain agile in the face of the unexpected.

Expanding capacity

While backfills remain the most common reason to use locums, that reason has been declining in importance, from 82% in 2023 to 67% in 2024. As patient volumes rebound, more healthcare organizations are turning to locums to sustainably supplement their core staff. One-third (35%) of clients use locums to "meet rising patient demand" and 28% to supplement staff during peak periods.5

This shift in reasons for placing locum tenens physicians reflects a growing effort to use locums more strategically, rather than reactively.

For example, a full 25% of facilities are using locum doctors to mitigate burnout and reduce staff workload in a strategic effort to reduce turnover. Others are using locum tenens to support organizational transitions (23%), create staffing flexibility (22%), or test-market new services (9%).5

To deliver on physician’s increasing expectations for schedule autonomy, provider organizations must embrace flexible scheduling and work models, such as part-time and telehealth-based work. Locums staffing may provide an opportunity to do this without disrupting patients’ access to care.”

– Sarah Roller, managing director, Physician and Medical Group Research, Advisory Board

The use cases for locum tenens go beyond filling in for or supplementing permanent physicians. The agility provided by locums allows healthcare organizations to test out new service lines, flex telehealth services to changing demand, offer expanded service hours, or staff a float pool to ensure continuity of services.

The growing role of APPs

Advanced practice providers remain a relatively small but rapidly expanding segment of the total locums industry, comprising about 15% of locum providers overall.6 However, these professions are growing at about twice the rate of their physician counterparts.

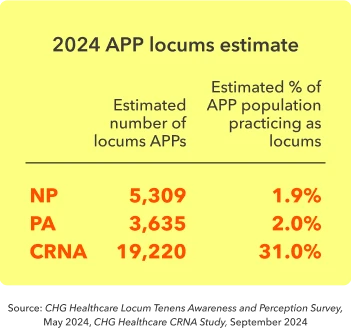

It's projected that over 28,000+ advanced practice providers currently work locum tenens, with CRNAs comprising a predominant share of that mix. These roles offer faster availability and lower cost for healthcare facilities, particularly in the areas of primary care and anesthesia, where physician shortages remain challenging.

Our analysis found that APPs made up the majority of the primary care workforce in non-metro areas as of 2021 and will make up the majority of the primary care workforce nationwide by 2031. Other specialty areas are quickly following suit as they recognize the potential for APPs to mitigate physician shortages and provide cost savings.”

– Sarah Roller, managing director, Physician and Medical Group Research, Advisory Board

Related reading: 3 ways to strategically deploy APPs in primary care

Over a third (39%) of healthcare facilities say they plan to increase their usage of APP locums in the coming year,5 and demand for CRNAs has increased rapidly, becoming the most requested specialty in Locumsmart. It’s estimated that demand for CRNAs will continue to grow by 25% this year, more than double the rate of NPs and PAs.6

Telehealth and virtual care

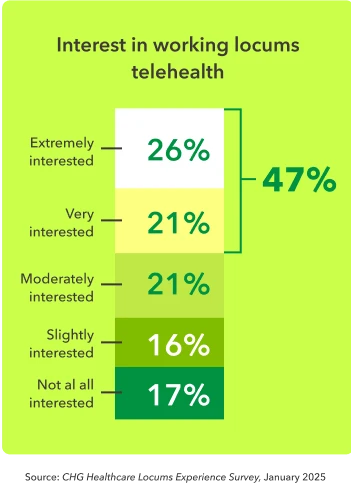

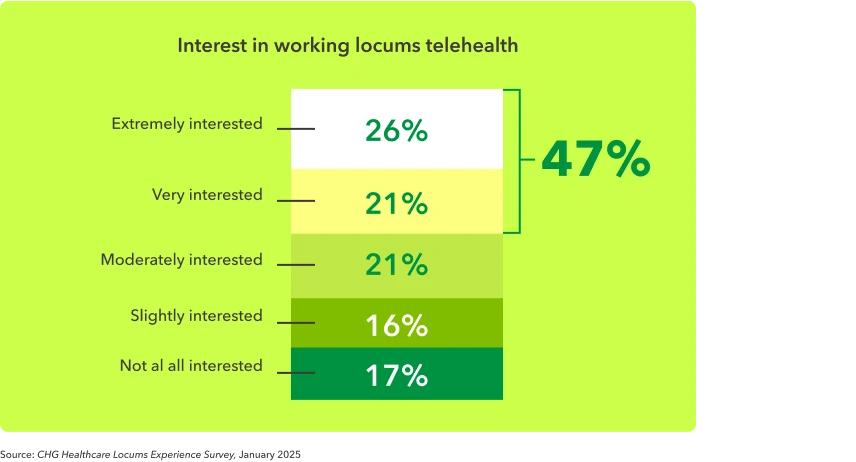

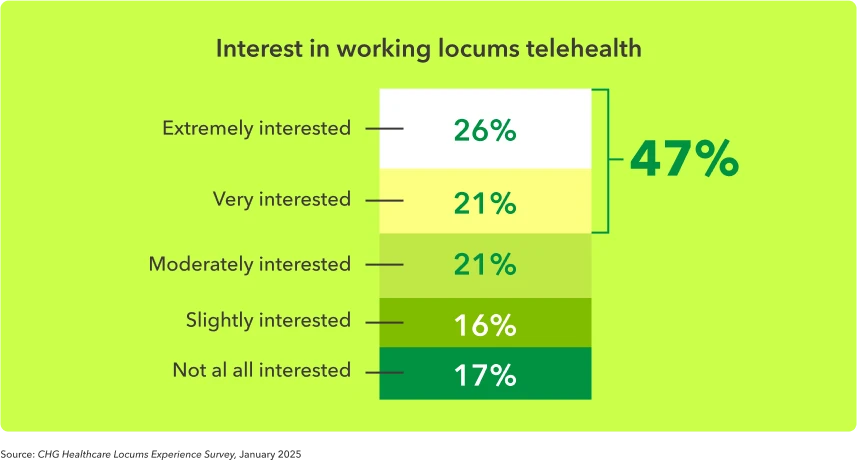

Telehealth represents another emerging use case for locums—and physicians want to do more of this kind of work. Nearly half (47%) of locum physicians are very or extremely interested in working telehealth locums, while another 21% are moderately interested.

Telehealth is well established in some specialties—such as psychiatry, where it accounts for 60% of visits, and urgent care—but remains in early stages of adoption in others. While some health systems have embraced virtual care as a cost-effective way to expand access, others have hesitated due to concerns about reimbursement and technology infrastructure. This data highlights strong provider interest in telehealth, suggesting that systems can unlock new candidate pools by further investing in virtual care capabilities.”

– Matt Brown, vice president, CHG Healthcare Advisory Services

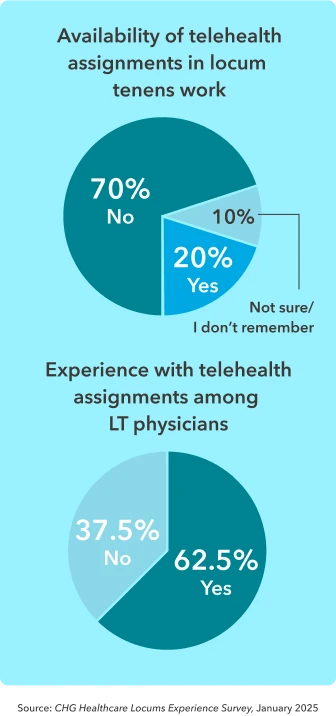

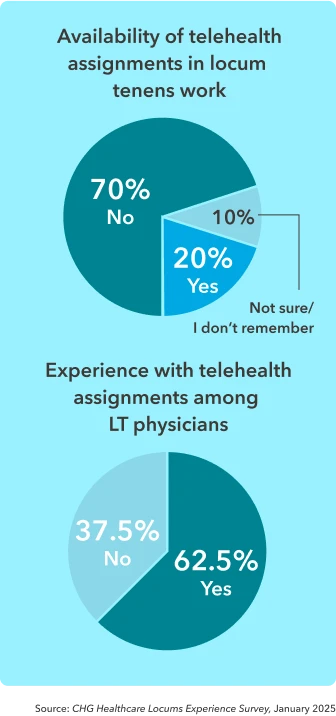

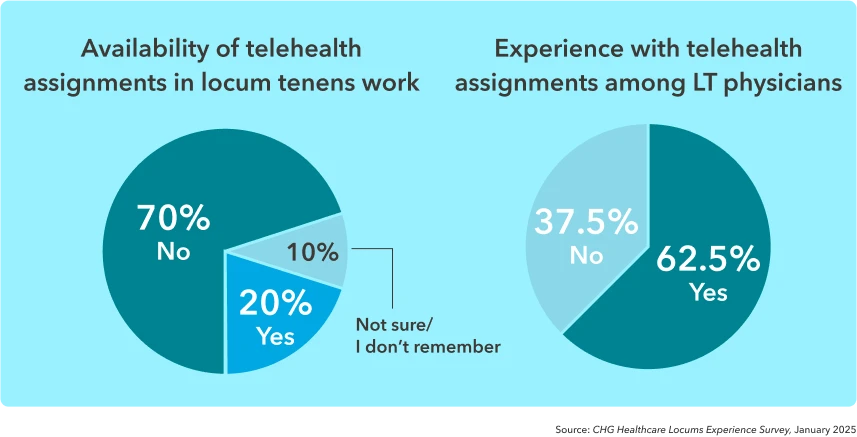

But interest doesn’t always align with opportunity. Only 1 in 5 physicians (20%) reported that telehealth locums assignments were available to them over the past year. This suggests a significant gap between demand and availability in the locum market.

Among those who were offered telehealth assignments, nearly two-thirds (62.5%) accepted and participated in them—highlighting that when these opportunities are available, physicians are very likely to take advantage of them.

Fortunately, deployment of locums in telehealth or hybrid roles is starting to gain traction among more innovative, forward-thinking healthcare organizations. For example, telehealth locums serve facilities like Samuel Simmonds Memorial Hospital, a state-of-the-art critical access hospital located 340 miles north of the Arctic Circle.

Fortunately, deployment of locums in telehealth or hybrid roles is starting to gain traction among more innovative, forward-thinking healthcare organizations. For example, telehealth locums serve facilities like Samuel Simmonds Memorial Hospital, a state-of-the-art critical access hospital located 340 miles north of the Arctic Circle.

We do a lot of telemedicine between subspecialists, so instead of having cardiology here, cardiology may set up and do a telemedicine visit with one of our nurses and the patient present and just make sure that the patients are still seeing the specialist that they need to see on a regular basis.”

– Susan Miklavcic, senior director of medical staff services at Samuel Simmonds Memorial Hospital in Utqiagvik, Alaska

The financial impact of locums

A tool for risk management and workforce optimization

In an environment marked by unpredictability, the flexibility of locums allows both physicians and the health systems they work in to adapt to changing conditions with more resilience.

Economic concerns of physicians

The AMA reports that physicians today earn 33% less than they did a generation ago, when adjusted for inflation. These declining reimbursement rates—especially from Medicare—are forcing many doctors to make difficult decisions: reducing clinic hours, cutting staff, and limiting the services they can offer. Ultimately, this isn’t just a financial issue. It’s a matter of access to care. If physicians can’t afford to keep their practices open or maintain adequate staffing, patients lose access to essential medical services.

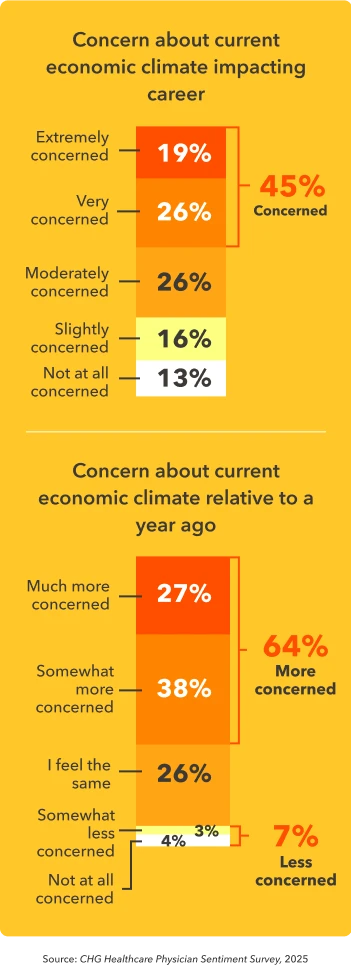

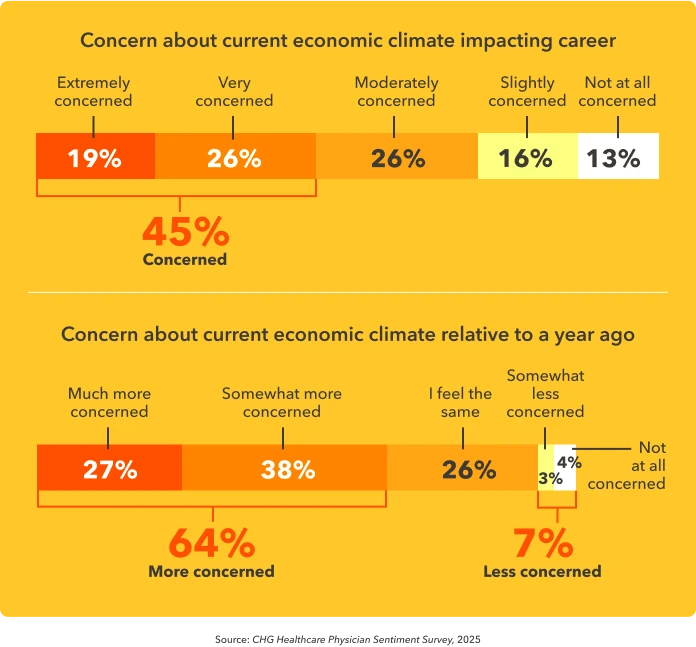

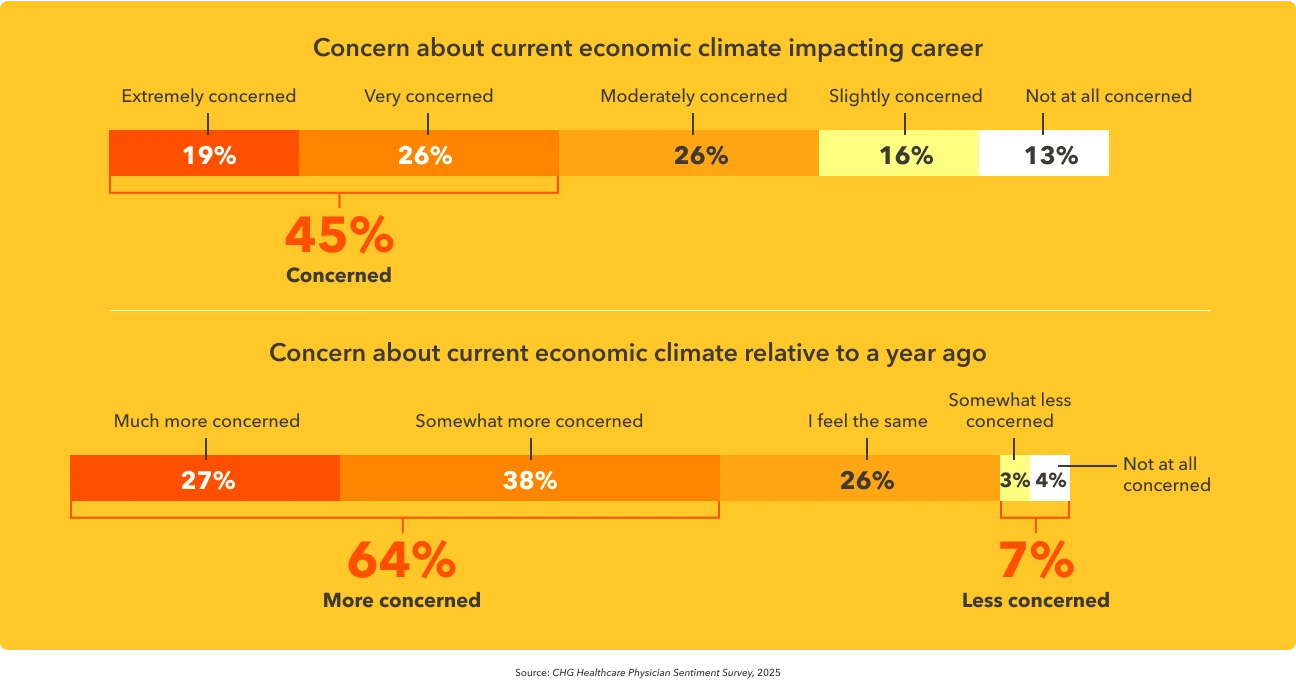

In 2025, nearly half (45%) of physicians reported feeling very or extremely concerned that the current economic climate will impact their career and/or professional future. This anxiety is increasing, as 64% said they are more concerned than they were a year ago.

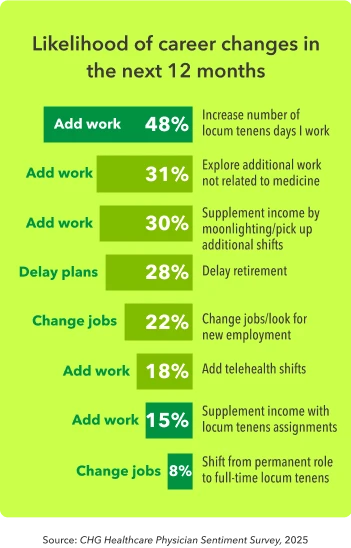

Locums plays a pivotal role in the response of physicians to this economic uncertainty. About 15% plan to supplement their income with locums assignments, while 8% intend to switch from permanent employment to full-time locums work. Of those already working locums, 48% plan to work more days.

Revenue loss prevention

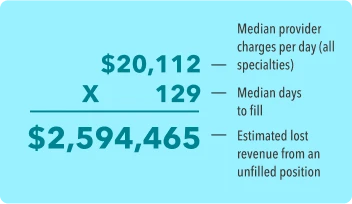

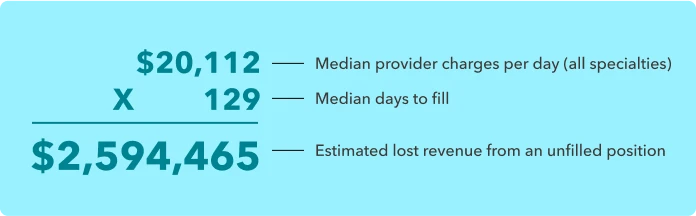

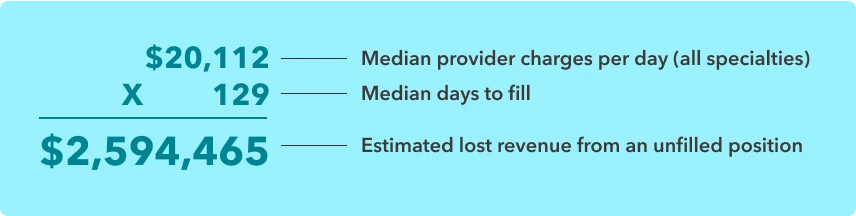

With the median physician search taking 129 days to fill,7 health systems are losing revenue for each day the role remains open. This means the lost patient revenue for a physician during a search is almost $2.6 million.9

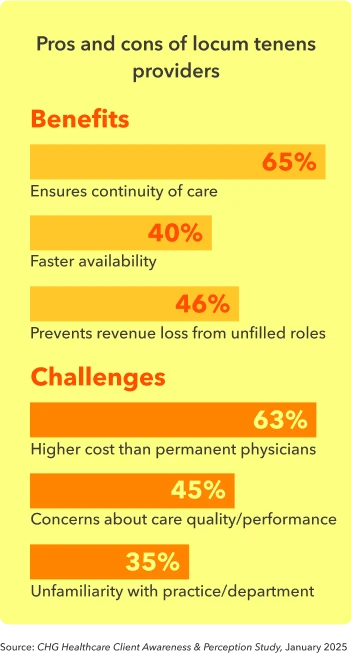

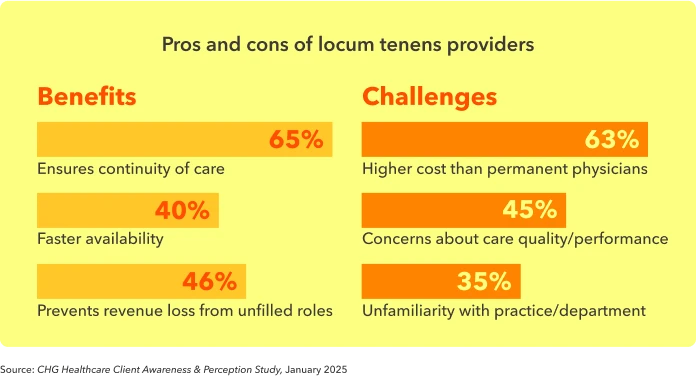

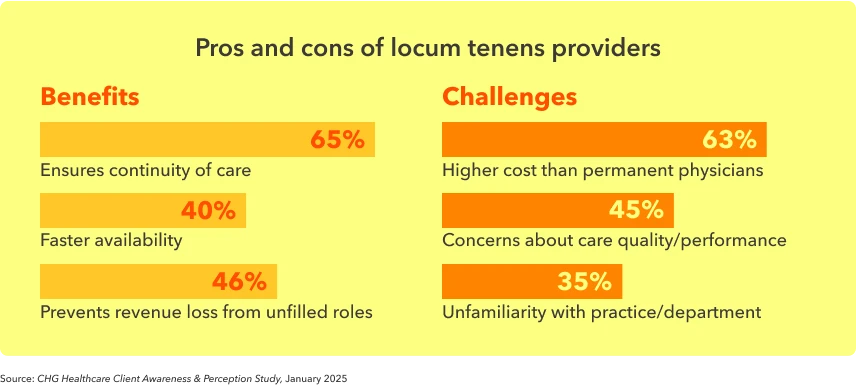

There are a number of trade-offs that healthcare staffing decision-makers weigh when considering utilizing locums providers.5

While the higher cost of locums relative to permanent staff is viewed as drawback for 63% of healthcare organizations, 65% also recognize that locums help ensure continuity of care.5

Ultimately, it’s a balancing act—healthcare organizations must navigate financial realities while staying true to their mission of delivering high-quality patient care. Locum tenens can be a strategic lever to help achieve both.

We view locums as a way to generate revenue and boost our workforce planning. Locum tenens is not just a cost center. It’s a tool for health outcome stability, which we are committed to.”

- VP, human resources

Revenue-generating opportunities

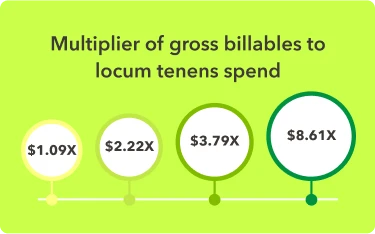

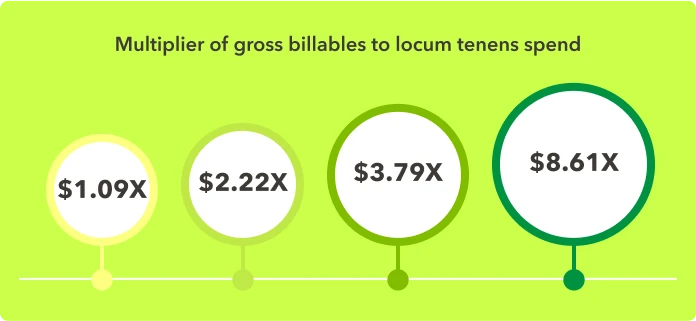

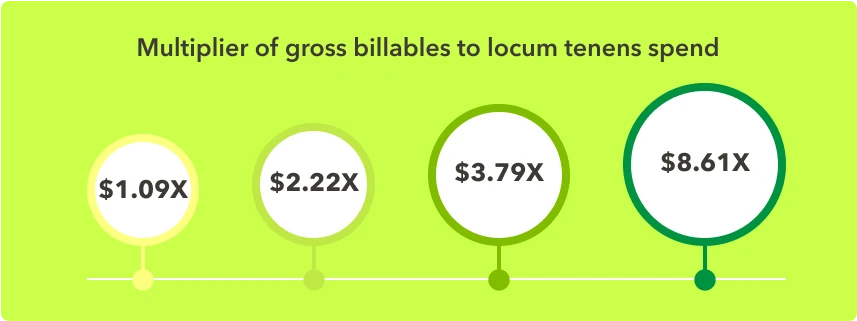

Beyond preventing loss of revenue, locums physicians can bring in net-new revenue when they are consistently and completely enrolled with payers. In fact, the average locums physician can generate a 5.6x return on investment, with some health systems realizing returns of more than 8x.2

Revenue loss prevention was cited by 46% of organizations as a benefit to hiring locums.5

Locums can mitigate financial risk in other ways as well. Physician burnout and turnover create tremendous costs for healthcare organizations, with the cost of replacing a physician reaching up to $1 million, according to AMA estimates.

Operational efficiencies through locums

While healthcare organizations are increasingly using locums as a lever for risk management, they are also focused on optimizing their locums programs for efficiency and cost savings. One way to gain efficiencies is to use NPs or PAs instead of higher-cost physicians.

Another optimization method is centralizing locums usage to one vendor or a small pool of vendors. Years of locums utilization combined with normal staff turnover can leave hospitals and health systems with a complex network of locums vendors. This complexity makes it difficult for organizations to gain a true picture of their locums usage and spend patterns across multiple facilities.

UnityPoint Health, a system that serves three states, found itself with a pool of up to 20 locum vendors, each with its own processes and pay rates. UnityPoint worked with CHG Healthcare to centralize its locums to one primary vendor and a small number of specialty locum tenens companies. As a result, the system can now better monitor locums spending and reallocate resources for greater efficiency.

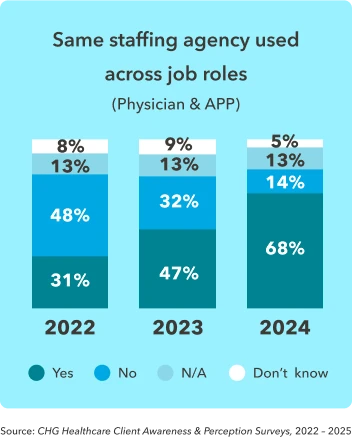

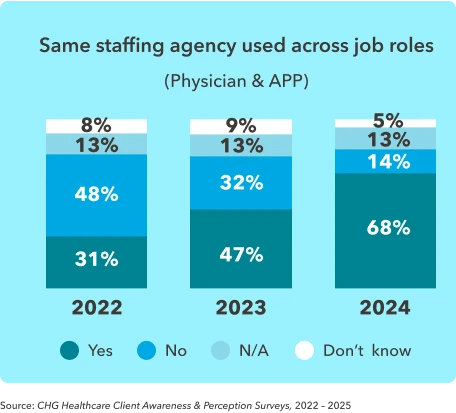

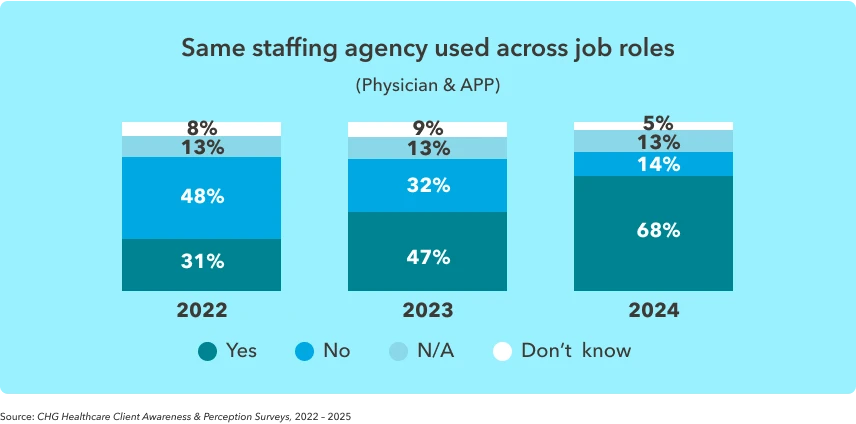

One step toward centralization is finding partners that can handle a wide variety of locums needs—for example, placing both APPs and physicians. About 68% of healthcare organizations now use the same vendor for APPs and physicians, over twice as frequently than just three years ago.

Technology’s role in locums management

Centralization is one way to manage the increasing complexity of locums programs. Another is the adoption of software platforms and AI-enabled solutions that offer easier methods for scheduling, invoicing, recruiting, communicating with vendors, and accessing data and analytics.

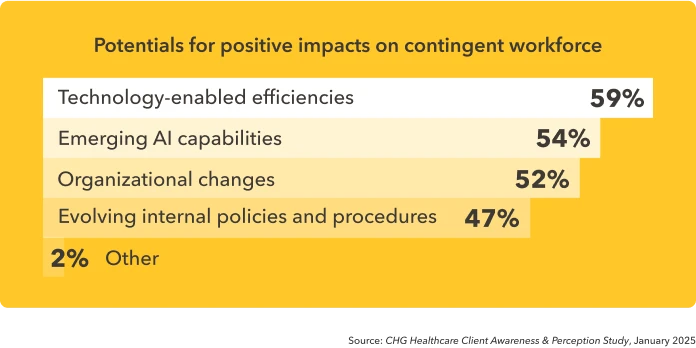

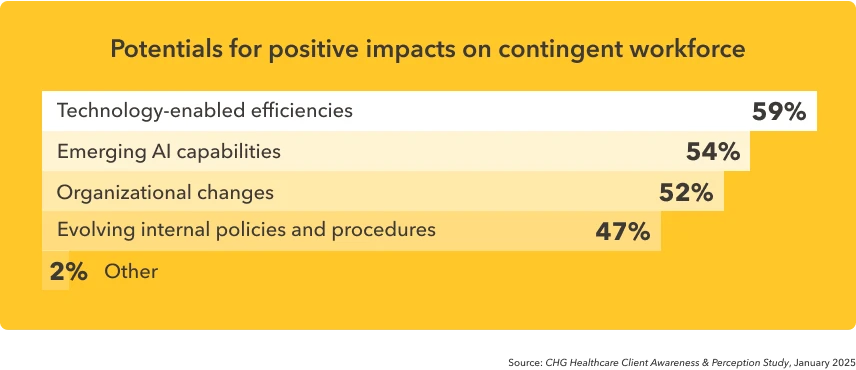

This proliferation of solutions speaks to the value of technology for supporting a contingent workforce. About 59% of organizations believe tech-enabled efficiencies would have a positive impact on their contingent workforce, while 54% see value in emerging AI tools.5

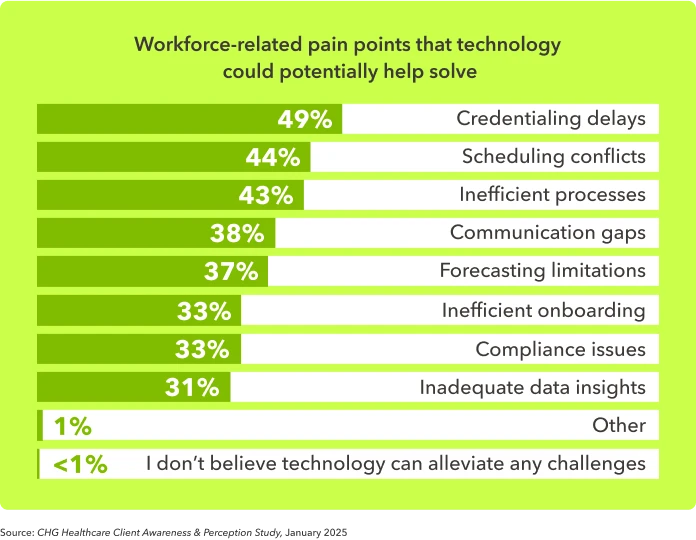

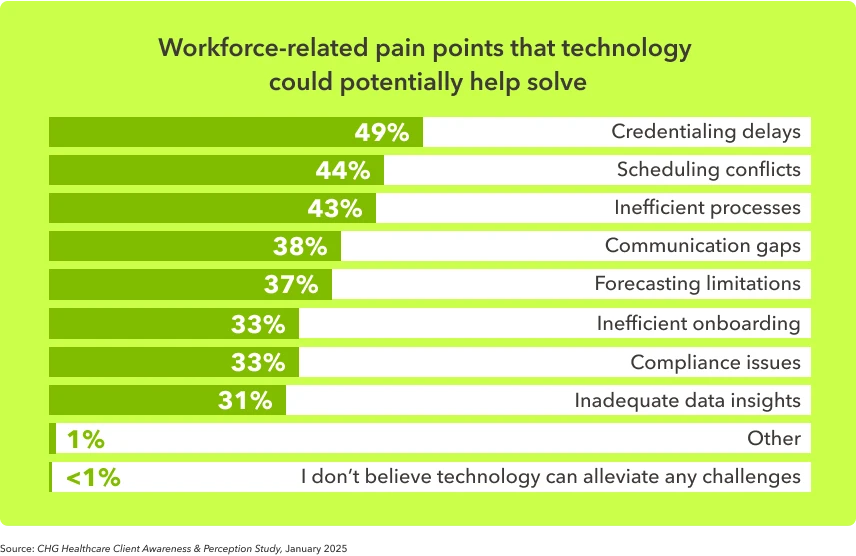

When asked what specific workforce-related pain point they believed technology could potentially help them solve in their organization, credentialing delays (49%), scheduling conflicts (44%), and inefficient processes (43%) topped the list.

Cloud-based credentialing platforms like Modio OneView are helping to reduce credentialing timelines while maintaining quality and compliance requirements.

Clean, complete submissions through payer-specific portals, paired with proactive follow-up, help prevent rework and keep credentialing moving—making technology a key tool for minimizing slow turnaround times.”

- John Bou, president, Modio

Staffing technology adoption is expanding rapidly in the healthcare industry, with 53% of systems now using a vendor management system (VMS). Moreover, healthcare organizations ranked technology-enabled efficiencies as having the most potential for positive impact on their organization's contingent physician workforce.

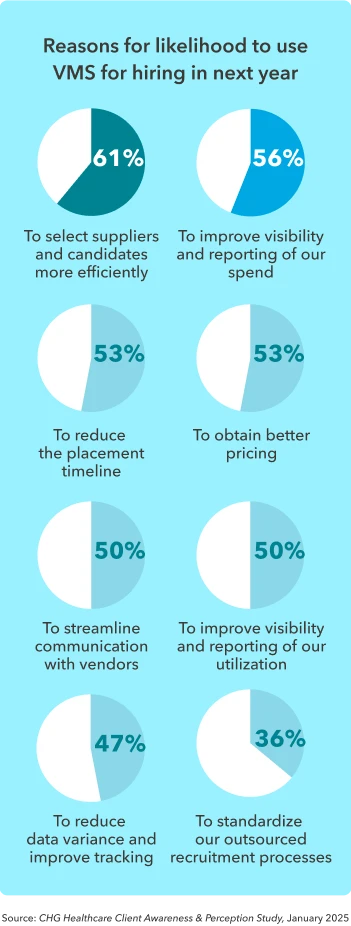

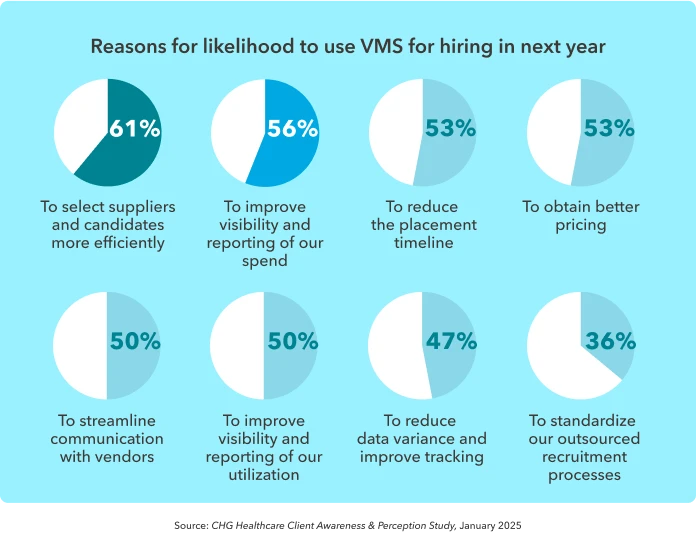

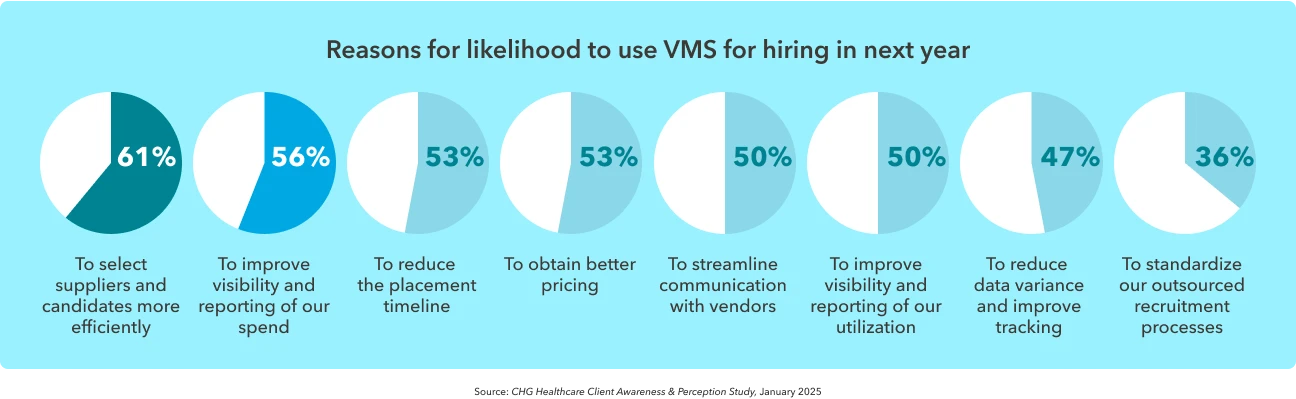

Health systems that have not yet adopted a VMS are considering doing so, with 20% reporting that they are somewhat or extremely likely to deploy a VMS within a year.5 Healthcare leaders report the most compelling motivations for VMS adoption include the ability to select suppliers and candidates more efficiently (61%), to improve visibility and reporting (56%), to reduce the placement timeline (53%), and to obtain better pricing (53%).

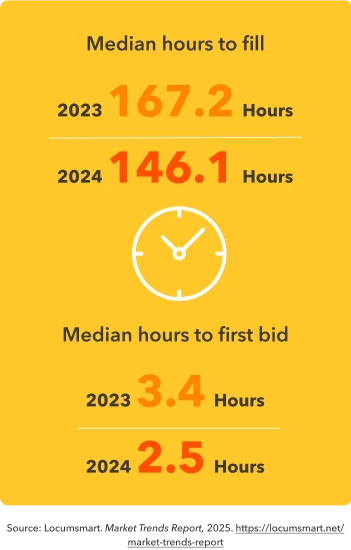

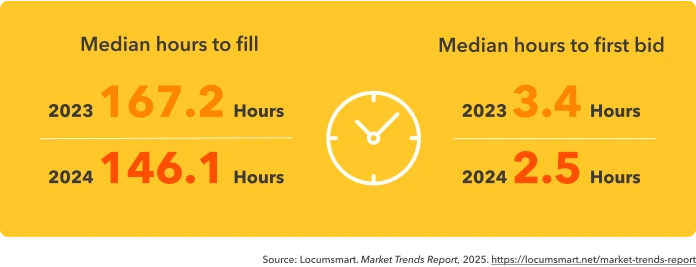

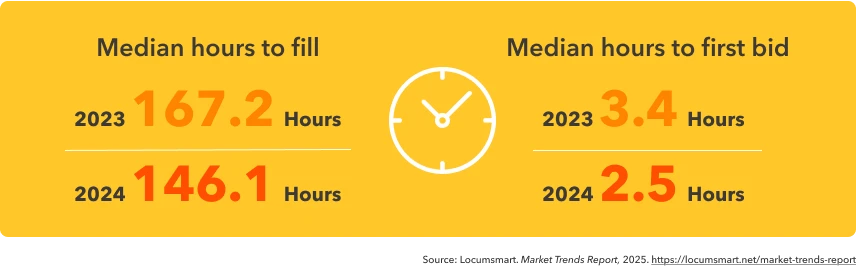

Data from health systems using Locumsmart demonstrate the real-world impact of a VMS in terms of efficiency gains. For Locumsmart users, the median number of hours to first bid declined by more than an hour, while the median time to fill an assignment reduced by almost a full day.

In addition to VMS products, integrated platforms are helping organizations streamline locum workflows without the need for formal implementation. These types of solutions can decrease reliance on things like manual workflows and email-based coordination, which have historically slowed down staffing timelines. For example, the CHG Connect platform consolidates access to multiple agencies—including CompHealth, Weatherby Healthcare, and Global Medical Staffing—enabling healthcare facilities to manage requests, track progress, and communicate with CHG teams in a single interface. Tools like these reflect a broader industry trend: the move from fragmented systems to integrated platforms that prioritize speed, transparency, and provider quality.

The locums paradigm shift

Because it solves a real need for flexible, on-demand coverage, locums has become a valued pillar in healthcare staffing. But the industry has evolved from its early days, with healthcare organizations becoming more deliberate and strategic with their locums programs in order to meet organizational goals, not just fill gaps.

Locums provides healthcare organizations with the flexibility to meet the ebbs and flows of demand, the ability to maintain revenue streams, and the leeway to explore new offerings. New technologies support this strategic solution with tools that help streamline workflows, reduce complexity, and harness the power of analytics to optimize provider utilization.

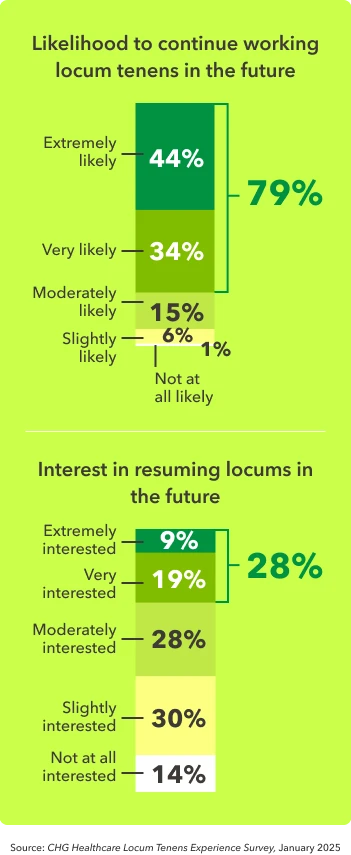

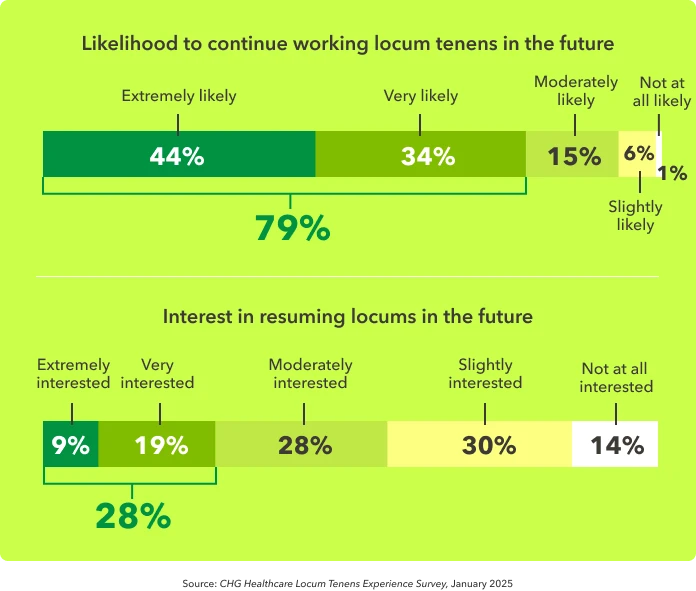

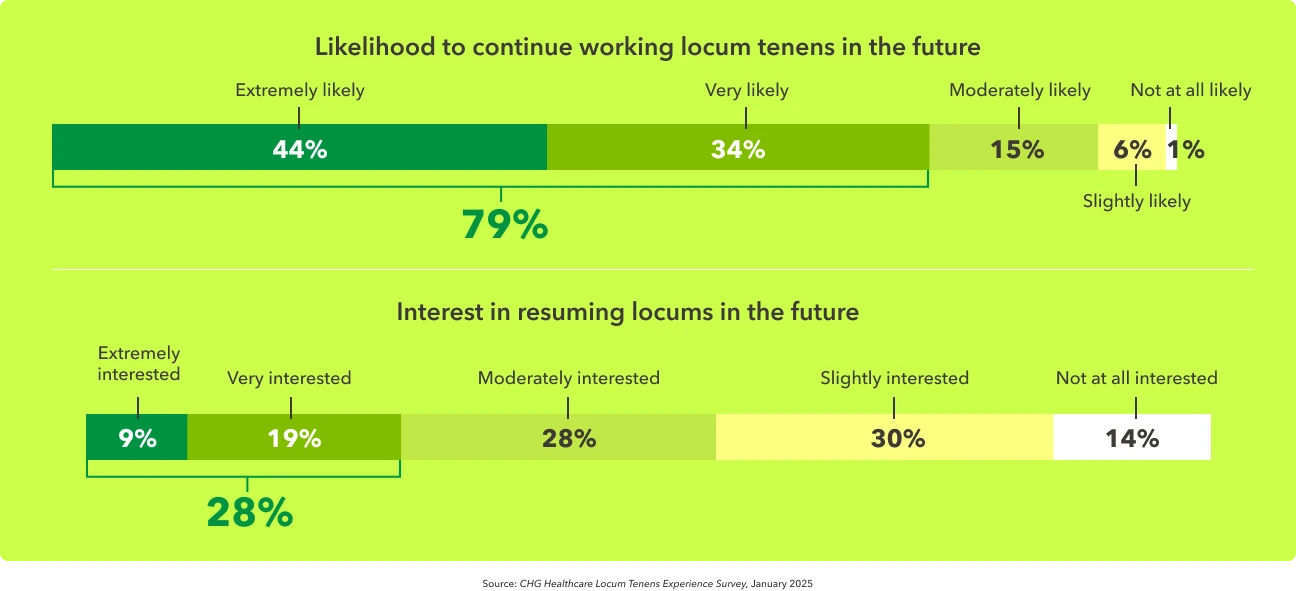

This paradigm shift is reflected in the growth of the industry—locums tenens is the only temporary healthcare staffing segment that has grown every year since 2021, and it’s projected to keep growing into 2026.1 Nearly three-quarters (71%) of all US-based physicians now report having a positive impression of locum tenens work.4 Of those who currently work locums, 79% are very or extremely likely to continue, and of those who worked locums previously, 28% are very or extremely likely to resume locums work in the future.

Now is the time for health systems to build locums into their strategic workforce plans to create stronger, future-focused organizations.

Finding the balance in healthcare

Thank you for taking the time to explore our 2025 State of Locum Tenens Report. We hope the insights provided have given you a clearer view of how locums is evolving—not just as a staffing solution, but as a strategic lever for flexibility, stability, and growth in healthcare delivery.

As the industry continues to navigate workforce shortages, shifting care models, and rising patient demands, it’s more important than ever to find adaptable solutions. Locum tenens is proving to be just that, offering value to both healthcare organizations and the providers who choose this path.

Whether you’re already using locums in a strategic way or just beginning to explore the possibilities, we believe this year’s findings can help guide your decisions and inspire new approaches to workforce planning.

At CHG Healthcare, we’re proud to support organizations like yours as you continue delivering high-quality care in a challenging and fast-changing environment. If you have questions about the report, or if you’d like to talk through what these trends might mean for your team, we’re always here to help. Here’s to building a stronger, more flexible future together.

Here’s to building a stronger, more flexible future together.

Bill Heller

COO, CHG Healthcare

Methodology

CHG Healthcare compiled these statistics from internal surveys issued to physicians and healthcare organization leaders, along with internal data and third-party sources.

Cited sources

- Staffing Industry Analysts. (2025). US Staffing Industry Forecast: September 2025 Update. Staffing Industry Analysts.

- CHG Healthcare. (2024). Locum Tenens Awareness and Perception Survey. Internal data. CHG Healthcare. (2025). Locums Experience Survey. Internal data. Estimate derived from internal CHG Healthcare survey data: 8% of eligible U.S. physicians (excluding foreign medical graduates) were working locum tenens in 2024 (≈57,000 physicians). Based on an average of 90 days worked per year and 22.5 patients per day, this equates to approximately 117.99 million patient visits annually—roughly one-third of the U.S. population.

- CHG Healthcare. (2025). Locums Experience Survey (n = 613). Internal data.

- CHG Healthcare. (2024). Locum Tenens Awareness and Perception Survey (n = 880). Internal data.

- CHG Healthcare. (2025). Client Awareness & Perception Study (n = 386). Internal data.

- Staffing Industry Analysts. (2024). US Temporary AP Staffing Market Survey. Staffing Industry Analysts.

- AAPPR – Association for Advancing Physician and Provider Recruitment. (2024). Physician and Provider Recruitment Benchmarking Report: Search Dynamics and Trends.

- CHG Healthcare. (2024). Client Awareness & Perception Survey (n = 183). Internal data.

- CHG Healthcare. (2024). Analysis of CPT and ICD-9 codes billed by locum tenens providers, based on data from CMS, Definitive Health, Purple Labs, and internal sources. Dataset covers approximately 73% of U.S. claims (commercial and CMS) with a 6 – 9-month lag. Actual hospital collections will vary.

CHG Healthcare and locum tenens

The locum tenens industry was started in 1979 by CompHealth’s founders to provide coverage for rural physicians who needed time off to receive updated training. Today, CHG Healthcare—the parent company of CompHealth, Weatherby Healthcare, Global Medical Staffing, Modio Health, Locumsmart, and Nursesmart—is committed to building a sustainable healthcare workforce that improves patient care wherever it’s needed most.

CHG Healthcare works with more than ten thousand locum tenens providers every year, who treat more than 11 million patients. Current estimates indicate that about 52,000 physicians work temporary locum tenens assignments in the U.S. annually, and CHG works with more than 21% of them.

Let’s connect

Schedule a workforce strategy session or risk assessment consult with CHG Healthcare’s Advisory Services team. We’ll evaluate your locums utilization, capture unrealized care opportunities, and provide insights on how to better manage your provider pool. To get started, simply fill out the form, call 866.570.9920 or email us at ecs.contact@chghealthcare.com.