Physicians are entering residency with more medical school debt than in years past, and it’s taking them longer to pay it off, according to a 2024 survey by CHG Healthcare. Physicians were asked about their debt, repayment strategies, and the impact of that debt on their career choices and mental health. The survey found that three-quarters of physicians have experienced medical school debt, and the overall toll it takes on them continues to increase.

Rising tuition is a significant factor in the escalation of med school debt. The cost to attend medical school has greatly outpaced currency inflation — over the past 22 years, medical school costs have increased 91% after adjusting for inflation. The result is that, at graduation, the average medical school student carries four times the debt burden of the average college student.

More physicians are accruing higher amounts of medical school debt

Overall, 74% of physicians report having previous or current med school debt, leaving 26% who have never had debt.

Some specialties are hit harder than others. Those more likely to have current or former debt include pediatric subspecialties (86%), pediatrics (84%), emergency medicine (84%), and primary care (83%).

The specialties that most likely never had school debt include internal medicine subspecialties (38%) and anesthesiology (36%).

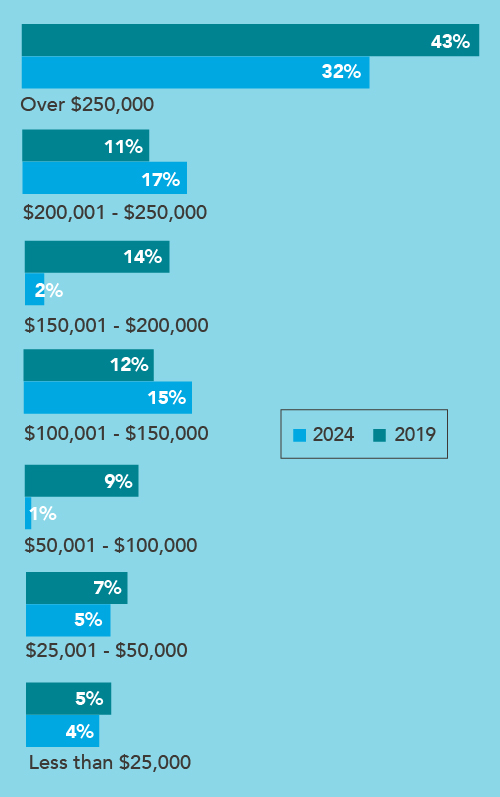

The average amount of debt is also growing. Nearly half (43%) of physicians who currently carry medical school debt owe more than $250,000. This is an 11% increase from a 2019 survey conducted by Weatherby Healthcare. In all, 68% still owe more than $150,000 — up from 51% in 2019.

Current medical school debt as reported by physicians

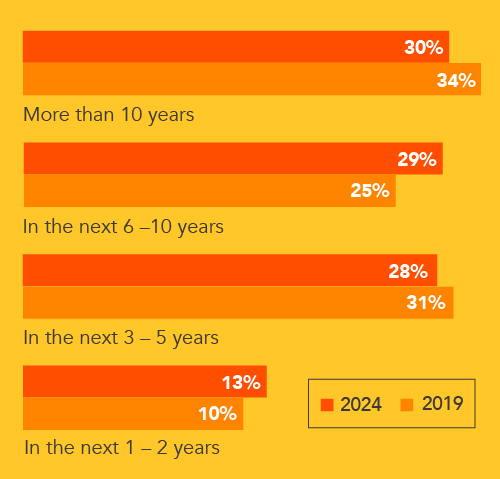

Anticipated debt repayment timeline varies by physician gender

Some notable differences emerged between male and female physicians, with men carrying higher amounts of debt while women take longer to pay debt off. For example, 46% of male physicians owe more than $250,000 in medical school debt, while only 38% of female physicians have that much debt.

About 45% of male physicians expect they’ll pay off their debt in five years or less, compared with 35% of female physicians. Only 29% of male physicians believe it will take 10 years or more to pay off their debt, compared to 32% of female physicians.

Altogether, 59% of physicians with debt expect it will take six or more years to pay off their debt, and 30% anticipate it will take 10 years or more.

Anticipated timeline for paying off medical school debt

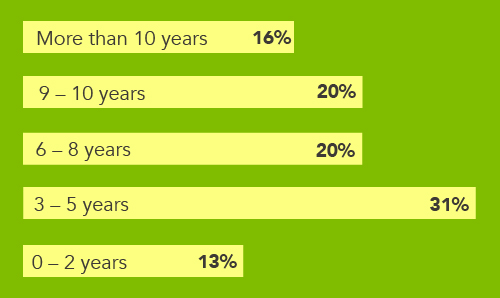

Actual medical school debt repayment timelines

Data from physicians who have already paid off their medical school debt show that physicians are working hard to pay off debt quickly. Of the physicians surveyed, about one-third (31%) of respondents reported having already paid off their medical school debt. Of those, 16% took 10 years or more to pay it off while over half (56%) took six years or more.

Actual timeline for medical school debt pay-off

Of those physicians who have paid off their debt, men and women report somewhat differing repayment timelines. Only 12% of male physicians took 10 years or longer to pay off their debt, while 21% of women took that long. About 48% of men paid off their debt in fewer than five years, compared with 39% of women.

Residents and their pay: Read the 2023 resident physician salary report [CompHealth]

Medical school is only part of physicians’ debt burden

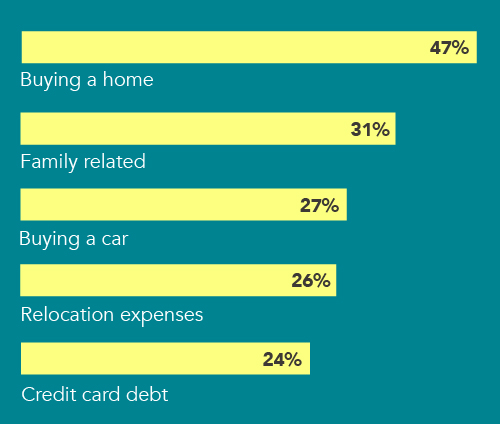

Medical school expenses are only one part of a physician’s overall debt picture. Common sources of additional debt include buying a home or a car, relocation expenses, credit card debt, and more. Roughly one in five physicians said they have no debt outside of their medical school debt. In the “Other” category, some physicians noted that they are in dual-physician households and, therefore, carry a double burden of medical school debt.

Top 5 additional contributors to existing physician debt

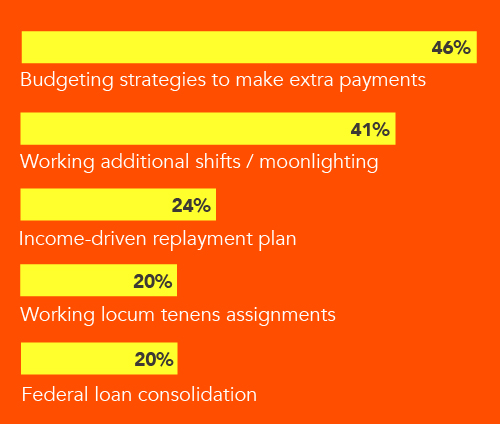

Physicians use a variety of debt payoff strategies

Physicians tackle their school debt in a variety of ways to pay it off as soon as possible. The most cited strategy is cutting expenses to make additional debt payments. “Live like a resident until it’s paid off,” advised one physician in the survey.

Others are taking extra shifts or moonlighting to bring in extra income. Similarly, 20% are working locum tenens assignments. “Delay all plans, work double shifts, and do side hustles,” advised a physician to those who want to “kill debt first.” Another simply said they wished they’d begun working locum tenens sooner.

About a quarter of physicians are relying on income-driven repayment plans, while 20% have turned to federal loan consolidation. “Consolidation into lower interest rate loans can be helpful,” advised one respondent. “Be sure your loans are ones that can be forgiven under government programs. Ask potential employers if they offer loan assistance.”

What’s your strategy? How 5 doctors are paying off their medical school loans [Weatherby Healthcare]

Top 5 physician debt repayment strategies

Personal and professional impact of medical school debt

Med school debt seems to have a greater impact on a physician’s post-training career choices than on the choice of specialty. A full 40% of physicians said debt had no impact on their choice of specialty, while only 17% said it impacted their choice either “a lot” or “a great deal.” On the other hand, twice as many (34%) said debt affected their post-training career choices “a lot” or “a great deal.”

Many physicians said their debt also impacted their mental health. Altogether, 32% reported debt affected their mental health “a lot” or “a great deal,” while 30% said it had a moderate impact. Only 16% said their debt had no impact on their mental health.

Methodology

CHG Healthcare surveyed more than 500 actively practicing physicians across the country to assess the impact of medical school debt. Respondents were asked specifically about the amount of debt they carry, factors that contribute to debt, strategies and timelines for paying it back, and how debt affects their career choices and mental health.

CHG can provide your healthcare facility with the locum tenens physicians and advanced practice providers you need to grow your organization. To learn more, contact us by phone at 866.588.5996 or email ecs.contact@chghealthcare.com.